Understanding PEPs: Definition, Types & Risk Levels According to FATF

The term "Politically Exposed Person" or PEP often comes up in conversations around anti-money laundering and combating the financing of terrorism (AML/CFT). But what exactly does it mean, and why should you care? When it comes to understanding what is a pep, it is essential to comprehend that these individuals possess great power, influence, and consequently, a higher propensity to engage in illicit activities such as bribery or money laundering.

In this comprehensive guide, we'll explore the intricate world of PEPs, as outlined by the Financial Action Task Force (FATF), the global money laundering and terrorist financing watchdog, and shed light on the significance of PEP screening in financial institutions.

What is a PEP and PEP according to FATF

A Politically Exposed Person (PEP) is an individual who has been entrusted with a prominent public function, either domestically or internationally. Due to their position and influence, PEPs are at a higher risk of being involved in bribery, corruption, or money laundering. The Financial Action Task Force (FATF) provides a detailed framework to understand the definition and types of PEPs, which serves as a global standard for nations and organizations alike.

Examples of PEP

PEPs are not just confined to politicians. They can also include senior government officials, judicial authorities, military officers, and even high-ranking members of state-owned enterprises. For instance, a mayor of a large city, a general in the army, or a CEO of a government-owned oil company could all be considered PEPs.

PEPs, as per the FATF classification, embody individuals who currently serve or previously held a significant public function in a country. The high-risk nature of these roles is often associated with an enhanced likelihood of their involvement in financial crimes. This susceptibility stems from their ability to influence decisions and control resources, which can potentially be exploited for personal gains. The following categories encapsulate the diverse roles that a PEP may hold:

- Government Roles: High-ranking officials in either the legislative, executive, or judiciary branches of government. This can range from members of parliament and supreme court judges to ambassadors and diplomats.

- Organizational Roles: Individuals holding prominent positions in governmental commercial enterprises or political parties. This could include board members of a central bank, party leaders, or high-ranking military officials.

- Associations: Close associates, either through social or professional connections, to a PEP. This could encompass family members, close relatives, or individuals holding beneficial ownership of a legal entity in which the government is a stakeholder.

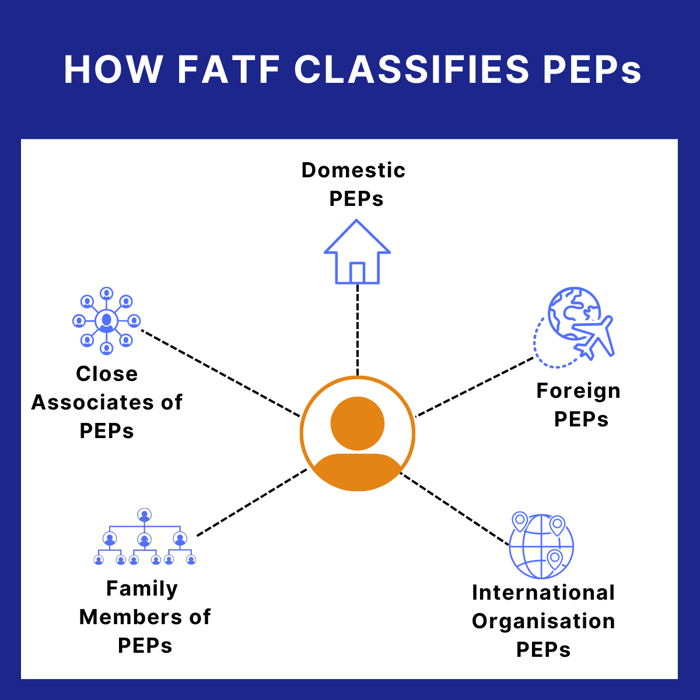

Types of PEP Defined by FATF

Bearing in mind the broad scope of what is a PEP, the FATF has further divided PEPs into three primary categories, namely Foreign, Domestic, and International Organization PEPs.

- Foreign PEPs: These are individuals who hold or have held prominent public positions in a foreign country. The risk associated with foreign PEPs is generally higher due to the challenges in obtaining accurate and timely data about these individuals.

- Domestic PEPs: These refer to individuals who hold or have held significant public functions within their home country. While they also pose a risk, it is generally lower than that of their foreign counterparts due to better access to information.

- International Organization PEPs: These are individuals who hold or have held a high-ranking position in an international organization. The risk associated with these PEPs can vary depending on factors such as the organization's transparency, the individual's role, and the level of oversight exercised.

PEP Risk Levels

Understanding the PEP definition is only the first step in managing financial crime risks. The subsequent step involves a detailed risk assessment, which is crucial for regulated corporations dealing with PEPs.

Risk associated with PEPs is generally assessed on multiple factors including the corruption level of the country they originate from, the nature of their role, and their access to significant financial resources. It's a tiered approach, ranging from low to high risk, and the scrutiny applied varies accordingly. The FATF outlines four levels of risk for PEPs:

- Low-level risk: This encompasses supranational or international business officials and senior functionaries, as well as members of local, state, district, and urban assemblies.

- Medium/low-level risk: This category includes top officials of government boards and state-owned enterprises such as heads of judiciaries, banks, military, law enforcement, and high-ranked civil servants in state agencies and religious organizations.

- Medium/high-level risk: This segment includes individuals who are members of the government, parliament, judiciary, banks, law enforcement, military, and prominent political parties.

- High-level risk: This is the highest risk category and includes heads of state or government, senior politicians, judicial or military officials, senior executives of state-owned corporations, and important party officials.

Red Flags to Watch Out for PEPs by FATF

Recognizing the potential risks associated with PEPs, the FATF has highlighted several red flags that can indicate suspicious activity. These indicators act as warning signals for possible financial abuse and can help corporations detect and control potential illegal activities involving PEPs. Here are some key red flags outlined by the FATF:

- Unusual Wealth: A drastic and unexplained increase in a PEP's wealth can be a significant red flag.

- Offshore Accounts: Frequent use of offshore accounts without a logical or apparent reason.

- Shell Companies: Involvement in operations through shell companies that lack transparency.

- Identity Concealment: PEPs might attempt to hide their identities to evade scrutiny. This could involve assigning legal ownership to another individual, frequently interacting with intermediaries, or using corporate structures to obscure ownership.

- Suspicious Behavior: This could include secrecy about the source of funds, providing false or insufficient information, eagerness to justify business dealings, denial of an entry visa, or frequent movement of funds across countries.

- Company Position: The PEP's position within the company could also raise concerns. This could include having control over the company's funds, operations, policies, or anti-money laundering/terrorist financing mechanisms.

- Industry: Certain industries are considered high-risk due to their nature and the potential for exploitation. This could include banking and finance, military and defense, businesses dealing with government agencies, construction, mining and extraction, and public goods provision.

Changes in PEP Status: An Evolving Landscape

The PEP landscape has witnessed several changes over the years, primarily in the definition and monitoring of PEPs. The term PEP was initially used to describe senior government officials and their immediate family members only. However, the definition has since been expanded to include individuals who hold prominent positions in international organizations, as well as their close associates. This change reflects the evolving nature of the global economy, where non-governmental organizations and international institutions wield significant power and influence.

The monitoring of PEPs has also evolved. Previously, self-disclosure was the primary method to identify a PEP, which was often ineffective, as some PEPs chose to hide their status or failed to disclose it accurately. Today, governments and financial institutions have access to sophisticated databases and screening tools, thanks to advanced AML compliance software, enhancing the ability to detect potential money laundering and corruption risks associated with PEPs.

Why PEP Screening is Important

Financial crimes pose a significant global concern, and organizations are obligated to comply with anti-money laundering regulations to combat such crimes. As part of this compliance, institutions must identify customers who may have a higher risk of being involved in financial crimes. PEP screening is a crucial process during account opening that helps identify high-risk customers and prevent financial crimes. Failure to adhere to these screening procedures can result in penalties from AML regulators for non-compliant organizations.

PEP screening is crucial because these individuals are at a higher risk of involvement in bribery, corruption, and money laundering due to their position and influence. Failure to conduct proper screening can result in heavy fines for the institution and reputational damage. More importantly, it can facilitate financial crimes that have societal impacts.

How Tookitaki Can Help

As an award-winning regulatory technology (RegTech) company, we are revolutionising financial crime detection and prevention for banks and fintechs with our cutting-edge solutions. We provide an end-to-end, AI-powered AML compliance platform, named the Anti-Money Laundering Suite (AMLS), with modular solutions that help financial institutions deal with the ever-changing financial crime landscape.

Our Smart Screening solution provides accurate screening of names and transactions across many languages and a continuous monitoring framework for comprehensive risk management. Our powerful name-matching engine screens and prioritises all name search hits, helping to achieve 80% precision and 90% recall levels in screening programmes of financial institutions.

The features of our Smart Screening solution include:

- Advanced machine learning engine that powers 50+ name-matching techniques

- Comprehensive matching enabled by the use of multiple attributes i.e; name, address, gender, date of birth, incorporation and more

- Individual language models to improve accuracy across 18+ languages and 10 different scripts

- Built-in transliteration engine for effective cross-lingual matching

- Scalable to support massive watchlist data

Final Thoughts

In order to mitigate the risks associated with PEPs, it is imperative for financial institutions to implement robust PEP screening processes within their compliance framework. By doing so, they not only shield themselves from potential involvement in illicit activities but also safeguard their reputation and actively contribute to the global fight against financial crime.

Tookitaki's innovative Smart Screening solution offers precise screening of customers and transactions against sanctions, PEPs, Adverse Media, and various watchlists in real-time across over 22 languages. With an impressive 90% accuracy rate, this cutting-edge technology utilizes 12 advanced name-matching techniques on 7 customer attributes, incorporating a multi-stage matching mechanism and cross-lingual matching capabilities. To explore more about the capabilities of Tookitaki's screening solution, schedule a consultation session by clicking the link below.

Frequently Asked Questions (FAQs)

What is a PEP according to FATF?

A PEP, according to FATF, is an individual who is or has been entrusted with a prominent public function, making them a higher risk for involvement in bribery and corruption.

What are some examples of PEPs?

Examples include politicians, high-ranking military officials, and senior executives in state-owned corporations.

Why is PEP screening important?

PEP screening is crucial for mitigating the risk of financial crimes like money laundering and corruption, which could result in severe penalties and reputational damage for the financial institution involved.

What are the types of PEPs defined by FATF?

FATF defines several types of PEPs including domestic, foreign, and those in international organisations.

What are some red flags to watch for in PEPs?

Red flags include sudden wealth accumulation, frequent use of offshore accounts, and involvement with shell companies.

Anti-Financial Crime Compliance with Tookitaki?