Compliance-as-a-Service (CaaS)

Compliance made Faster, Scalable and Secure

Compliance Must Respond Faster

Threats

Fraud and money laundering threats are evolving rapidly fuelled by access to technology.

Scale

The explosive growth of the global payment market and the associated complexities require a multi-jurisdictional AML solution.

Cost

The cost of compliance is rising 15%-20% annually largely driven by resource cost and high infra cost.

Tailor-made for Fast-growing Companies

Complete Risk Coverage

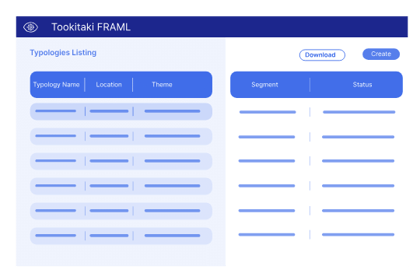

Download the latest AML and transaction fraud insights shared by a global network of experts and quickly test and deploy the scenarios with a fully automated simulation mode within 24 hours at no additional cost.

Scale Seamlessly

Process billions of transactions seamlessly with a powerful modern data engineering tech stack that scales horizontally.

No Upfront CAPEX

Get fully managed support with included infrastructure maintained by Tookitaki. Get free product version upgrades and access to new features.

What Does This Mean For You?

100%

Risk Coverage

(Industry average: 50-60%)

200

Transactions Per Second

(Industry average: 50 TPS)

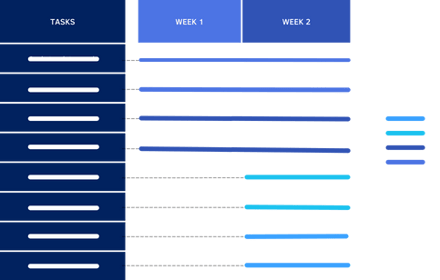

<4

Weeks to Go-live

What Makes CaaS Unique?

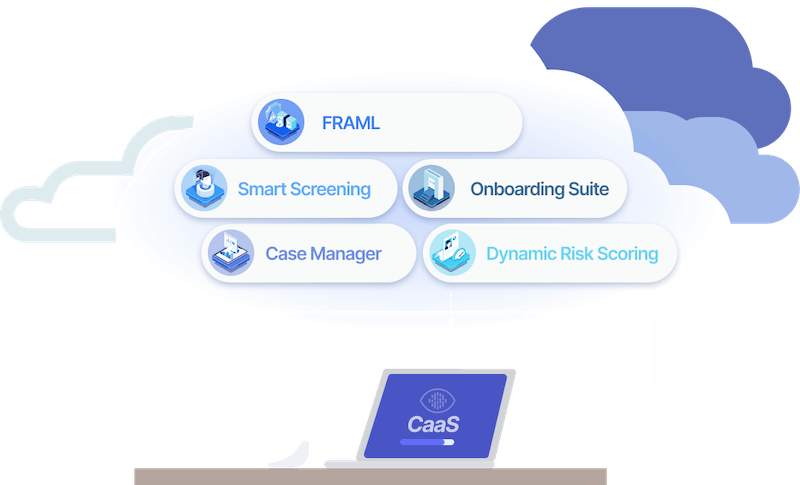

Industry’s Most Intelligent Fraud and AML Platform

Get complete protection from financial crime with an end-to-end operating system that meets all your compliance requirements.

Free Up-to-date Risk Coverage

Avail of new and emerging typologies at no additional cost from the AFC Ecosystem, allowing you to stay ahead of emerging fraud and AML threats.

Faster Time to Market

Centrally hosted cloud-based delivery. Go live in <4 weeks instead of months with seamless integration via APIs.

Real-time and Scalable Architecture

Horizontally scalable, modern data engineering stack that processes billions of transactions with >200 Transactions Per Second (TPS) rates with 99.9% platform availability.

Data Privacy and protection

SOC 2 compliant, multi-level security controls to ensure that your sensitive data is safeguarded every step of the way.

.png?width=440&height=280&name=data%20privacy%20(1).png)

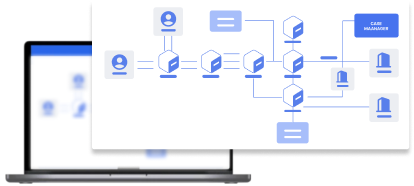

AMLS Solution

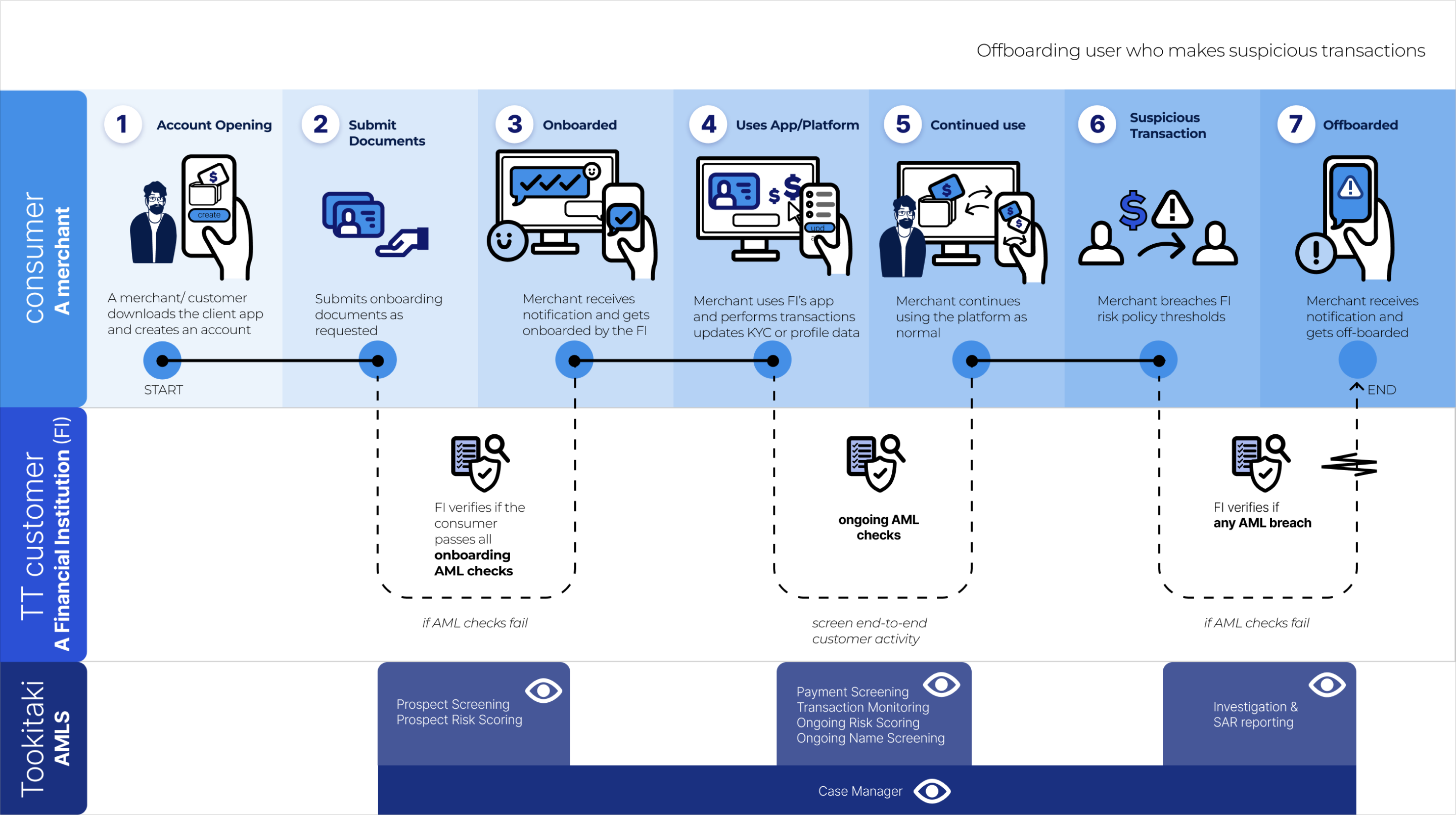

Tookitaki's AMLS is an end-to-end operating system that helps financial institutions detect and prevent financial crimes. It includes several modules such as Transaction Monitoring, Smart Screening, Customer Risk Scoring, and Case Manager. These modules work together to provide a comprehensive compliance solution that covers all aspects of AML including detection, investigation and reporting.

Our Thought Leadership Guides

Dynamic Risk Rating: The AI-Powered Future of CDD

Navigating Screening Challenges: Part 2

How does AMLS help you?

Scale Up Faster

The detection component of our AMLS called “Intelligent Alert Detection (IAD)” is an end-to-end suite of primary AML compliance solutions that work together seamlessly to protect your business from onboarding and ongoing AML risks without needing a large compliance team.

Reduce Your Compliance Cost

AMLS can also serve as a secondary AML compliance solution that will help your compliance team to sift through the large alert volumes generated by your primary AML compliance solution, identify false positives and focus on high priority risk alerts.