Reduce Non-compliance With

Continuous Monitoring

Improve the effectiveness of your CDD programme with an accurate 360-degree customer risk profile based on multiple dimensions using advanced machine learning models.

Our Impact (Annually)

5 Billion+

Transactions Monitored

400 Million+

Accounts Monitored

2 Million+

Alerts Processed

Partners Who Trust Us

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

.png?width=318&height=199&name=Customer%20Logos%20(1).png)

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

.png?width=318&height=199&name=Customer%20Logos%20(1).png)

- |

-

- |

-

- |

-

- |

Customer Risk is Always Changing

Risk

Accuracy

Due Diligence

De-risk Business with Dynamic Risk Scoring

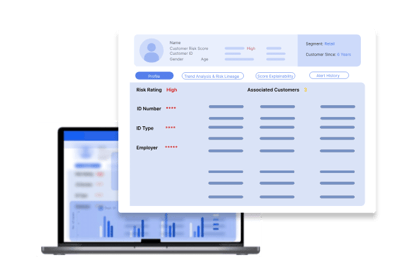

360-degree Risk View

Get a holistic customer risk profile based on multiple dimensions such as demographics, geography, screening and transactional patterns.

Accurate Risk Score

Get a more accurate risk score through our pre-configured rule engine with 160+ rules and unsupervised and supervised machine learning models.

Continuous Monitoring

Streamline due diligence with an automated event-driven risk profiling which triggers based on customer behaviour.

What Makes Customer Risk Scoring Unique?

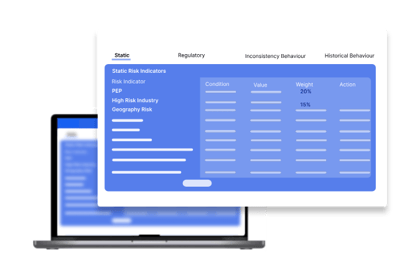

Real-time Risk Scoring

Real-time APIs to accurately risk score prospects using pre-configured rules for safer onboarding.

Pre-configured Rule Engine

Extensive profile-based risk scoring with 160+ pre-configured rules and the option to configure new rules to align with business-specific risk.

Dynamic Risk Engine

Get accurate risk scores through our dynamic risk engine using unsupervised models to compare customer behaviour with that of their peers and supervised learning to compare the customers' behaviour with their historical behaviour.

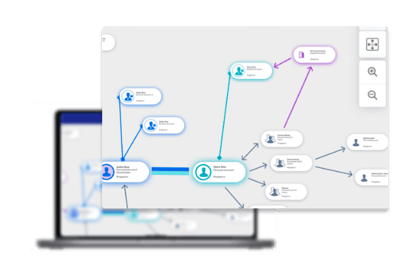

Network Visualization

Identify complex relationships and visualize hidden risks among different customers and Interested Parties.

What Do Our Customers Say?

-

Traditional Bank

-

Digital Bank

-

Payments

-

E-Wallet

Traditional Bank

Compliance Office of a Singapore Bank

-

50%

reduction in false positives -

~45%

reduction in overall compliance cost -

Digital Bank

For a new business like ours, Tookitaki's FinCense has been a perfect partner to help us effectively manage our compliance needs.

Digital Bank Client

.png?width=220&height=416&name=Group%2014246%20(1).png)

-

100%

Risk coverage for transactions

-

50%

Reduction in time to onboard to new scenario -

Payments

FinCense's ability to detect AML and fraud risk accurately in real time allows us to maintain the performance of the system at scale. It has been a game-changer for us.

Payment Services Client

.png?width=220&height=416&name=Group%2014246%20(2).png)

-

70%

Reduction in effort on threshold tuning and scenario testing -

90%

Reduction in false positives -

E-Wallet

Tookitaki helped us simplify our compliance operations by providing us with a single platform that effectively manages all fraud and AML processes.

E-Wallet Client

-

90%

Accuracy in high-quality alerts -

50%

Reduction in time to onboard to new scenario -

Frequently Asked Questions

Have Question? We are here to help

What is AML Customer Risk Scoring, and how can it help my organization in assessing and managing risk?

AML Customer Risk Scoring assesses and manages the financial crime risk associated with customers. It provides a 360-degree risk profile of your customer enabling you informed decision-making for your organization.

How does Tookitaki's AML Customer Risk Scoring solution work to evaluate and assign risk scores to customers?

Tookitaki's AML Customer Risk Scoring solution evaluates customer behaviour, transaction history, historical alerts and other variables. It has a dynamic risk rating engine which automatically adapts to changing data to calculate an accurate risk score.

What factors or variables are considered in the AML Customer Risk Scoring process?

The AML Customer Risk Scoring process considers factors like transaction patterns, geographic locations, customer profiles, business relationships and historical alerts. Customer Risk Scoring Solution can be extended to include external 3rd party data as well.

Can the AML Customer Risk Scoring solution be tailored to suit the specific risk assessment requirements of my organization?

Yes, the AML Customer Risk Scoring solution is customizable to align with your organization's specific risk assessment needs. It provides the option to configure rules and create your own as well.

How accurate and reliable is the risk-scoring methodology employed by Tookitaki's solution?

Used by many clients, Tookitaki's risk-scoring methodology is highly accurate and reliable. It uses both preconfigured rules and dynamic risk indicators to calculate highly accurate risk scores even with changing customer behaviour.

What are the benefits of using AML Customer Risk Scoring in compliance with anti-money laundering regulations?

Using AML Customer Risk Scoring ensures you have access to an accurate and 360-degree risk profile. It reduces ongoing due diligence effort, reduces misclassification and reduces the risk of non-compliance.

Can the AML Customer Risk Scoring solution integrate with other systems or data sources for a comprehensive risk assessment?

Yes, the solution can integrate with various systems and data sources, including transaction data, watchlists, and external feeds, for comprehensive risk assessment.

Are there any case studies or success stories demonstrating the effectiveness of Tookitaki's AML Customer Risk Scoring in real-world scenarios?

Yes, there are real-world case studies and success stories that showcase the effectiveness of Tookitaki's AML Customer Risk Scoring solution in identifying and managing risks for financial institutions. Contact us to learn more.

How can I implement Tookitaki's AML Customer Risk Scoring solution in my organization?

We offer both enterprise and SaaS models for quick and easy deployment. Based on your specific requirements our experienced implementation team can help you.

Is there a demo or trial available for the AML Customer Risk Scoring solution, and how can I get started?

Yes, you can request a demo of the AML Customer Risk Scoring solution with one of our experts to explore its capabilities and benefits, and our team will guide you through the process.

Our Thought Leadership Guides