Reduce False Positives and Focus On Material Risk

Drive efficiency and reduce operating costs with a fully automated AI alert prioritisation engine

Our Impact (Annually)

5 Billion+

Transactions Monitored

400 Million+

Accounts Monitored

2 Million+

Alerts Processed

Our Impact (Annually)

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

.png?width=318&height=199&name=Customer%20Logos%20(1).png)

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

.png?width=318&height=199&name=Customer%20Logos%20(1).png)

- |

-

- |

-

- |

-

- |

Cost of Compliance is Rising

Alert Backlogs

False Positives

Cost

Reduce Operational Noise with Smart Alert Management

Drive Efficiency

Eliminate false positives with our proprietory machine learning models. Drive productivity as you focus only on material risk.

What Does This Mean For You?

50%

False Positive Reduction

(Transaction Monitoring)

70%

False Positive Reduction

(Screening)

50%

False Positive Reduction

(Customer Due Diligence)

What Makes Smart Alert Management Unique?

Powerful AI Engine

Reduce false positives and focus on material risk with:

- Supervised and Unsupervised machine learning model

- Accurate identification of 90% low-value alerts and focus on material risk.

Self-learning Mechanism

Get consistent and high accuracy over time with a built-in champion challenger framework that learns from investigator feedback and changing customer behaviour.

Explainable AI Framework

Improve investigation and audit using a fully transparent ML model providing glass box explainability for alert analysis.

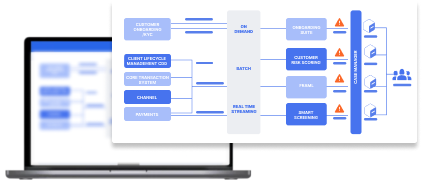

Seamless Integration

Seamless integration with existing legacy systems with a standardised data model and built-in connectors for faster go-live.

What Do Our Customers Say?

-

Traditional Bank

-

Digital Bank

-

Payments

-

E-Wallet

Traditional Bank

Compliance Office of a Singapore Bank

-

50%

reduction in false positives -

~45%

reduction in overall compliance cost -

Digital Bank

For a new business like ours, Tookitaki's FinCense has been a perfect partner to help us effectively manage our compliance needs.

Digital Bank Client

.png?width=220&height=416&name=Group%2014246%20(1).png)

-

100%

Risk coverage for transactions

-

50%

Reduction in time to onboard to new scenario -

Payments

FinCense's ability to detect AML and fraud risk accurately in real time allows us to maintain the performance of the system at scale. It has been a game-changer for us.

Payment Services Client

.png?width=220&height=416&name=Group%2014246%20(2).png)

-

70%

Reduction in effort on threshold tuning and scenario testing -

90%

Reduction in false positives -

E-Wallet

Tookitaki helped us simplify our compliance operations by providing us with a single platform that effectively manages all fraud and AML processes.

E-Wallet Client

-

90%

Accuracy in high-quality alerts -

50%

Reduction in time to onboard to new scenario -

Frequently Asked Questions

Have Question? We are here to help

What is Smart Alert Management, and how can it benefit my organization in combating financial crime?

Smart Alert Management (SAM) is a Tookitaki solution that drives operational efficiency across AML programs in banks and fintechs by reducing false positives.

Is Smart Alert Management customizable to meet the specific needs and compliance requirements of my organization?

Yes, Smart Alert Management comes with pre-built machine learning models that train on your organization’s data to align with your unique requirements and risk appetite. Thus it delivers superior results compared to off-the-shelf models which are pre-trained.

What types of data sources does Tookitaki's Smart Alert Management integrate with for improved efficiency?

Tookitaki's solution integrates with various data types, including transaction data and customer profiles to enhance its efficiency.

How does Smart Alert Management handle false positives and reduce the number of unnecessary alerts?

Can Smart Alert Management seamlessly integrate with our existing systems and workflows?

Yes, Smart Alert Management is designed for seamless integration with your existing systems and workflows.

What are the industry regulations and compliance standards that Smart Alert Management caters to?

Are there any success stories or case studies demonstrating the effectiveness of Tookitaki's Smart Alert Management in real-world scenarios?

Yes, Tookitaki's Smart Alert Management demonstrated success in real-world scenarios, effectively detecting and preventing money laundering activities for various financial institutions. Contact us for specific case studies.

How can I get started with Tookitaki's Smart Alert Management solution? Is there a free trial or a demo available?

To get started with Tookitaki's Smart Alert Management solution, you can talk to one our experts and explore its features and benefits.

Our Thought Leadership Guides