Future of e-payments in Thailand: Exploring the rise of mobile wallets

The growth of digital payments in Thailand has been significant over the past few years, with mobile payments being one of the key drivers. The rise of mobile payment platforms has provided consumers with a convenient and secure way to make transactions. According to a report by the Electronic Transactions Development Agency, mobile payments in Thailand increased by 85% in 2020 compared to the previous year. This growth can be attributed to several factors, including the increased availability of smartphones, the government's push for cashless payments, and the impact of the COVID-19 pandemic. In this blog post, we will explore the rise of mobile payments in Thailand and the anti-money laundering (AML) compliance challenges associated with it.

Benefits of Mobile Payments

Mobile payments have become increasingly popular in Thailand due to their numerous benefits to consumers and businesses. One of the key advantages of mobile payments is the increased convenience and accessibility they provide. With mobile payment apps, users can easily transfer funds and make purchases using their smartphones anytime and anywhere. This eliminates the need for physical cash or credit cards, which can be lost, stolen, or damaged.

Mobile payments also offer significant savings for businesses, eliminating the need for expensive point-of-sale systems and payment terminals. This can be especially beneficial for small businesses and entrepreneurs who are looking for ways to reduce overhead costs.

Another benefit of mobile payments is the reduced reliance on cash payments. This can help lower the risk of theft and fraud and reduce the cost of printing and handling physical cash. Moreover, mobile payments can help boost the country's economy by making it easier for consumers to make purchases and for businesses to accept payments. This can lead to increased sales, improved cash flow, and more opportunities for growth and expansion.

Mobile Payment Market Landscape in Thailand

The Thai government's Thailand 4.0 economic scheme aims to improve the country's digital infrastructure and promote digitalization and technological progress. As a part of this strategy, the utilization of digital payments has become increasingly important in Thailand. The Bank of Thailand introduced the PromptPay system in 2017, which uses a user's citizen identification number or mobile telephone number to connect to their bank account and transfer money with the recipient's phone number instead of using detailed bank account credentials. PromptPay has transformed the way Thai consumers send and receive money, opening the door for further development in digital payments. E-wallets, which are mostly operated by private corporations, have also become a popular alternative payment method in Thailand, with mobile wallet users forecasting to reach almost 68 million across different brands by 2025.

The mobile payment market in Thailand is currently dominated by several key players such as TrueMoney, PromptPay, Rabbit LINE Pay, and AirPay. These companies have made significant strides in advancing the adoption of mobile payments across the country. In 2019, mobile payments in Thailand amounted to approximately 29.9 billion U.S. dollars, and this number is expected to continue growing in the coming years.

However, the market also faces challenges, such as a lack of interoperability between different payment systems and the need for increased security and financial crime prevention measures. Despite these challenges, the mobile payment market in Thailand has the potential to grow even more and become a vital part of the country's economy. With more consumers and businesses adopting mobile payment technologies, the market is poised for growth and innovation in the coming years.

AML Compliance Challenges of Mobile Wallets

As e-payment transactions increase in Thailand, e-wallet firms face stringent anti-money laundering (AML) regulations to ensure the security of the payment system. The Bank of Thailand (BOT) has set out AML compliance requirements for these companies to operate legally in the country. The AML regulations are meant to combat money laundering activities and terrorism financing.

Despite the importance of AML compliance, e-wallet providers face various challenges in achieving it. Some of the challenges include the lack of standardisation in AML regulations, insufficient training for employees, and the high costs associated with implementing AML compliance programs.

Failure to comply with AML regulations can lead to severe penalties, including fines, imprisonment, and revocation of licenses. Therefore, payment companies must prioritise AML compliance to ensure their business continuity and reputation.

The Role of Technology in AML Compliance for Payment Companies

In today's digital era, the use of technology has become essential in various fields, including AML compliance for payment companies. Technology can help streamline compliance procedures and can assist companies in identifying suspicious transactions accurately and quickly. By leveraging technology, companies can enhance their AML compliance frameworks, reduce the risk of financial crimes, and ensure they remain compliant with regulatory requirements.

Advancements in technology have led to the development of AML compliance solutions that can assist companies in various ways, such as automating transaction monitoring, implementing risk-based approaches, and conducting enhanced due diligence checks on customers. These technologies can help improve operational efficiencies, minimise manual efforts, and reduce compliance costs, making AML compliance more accessible and effective.

Overall, the use of technology in AML compliance can provide payment companies with a comprehensive and efficient approach to tackling financial crimes, reducing the risk of penalties and reputational damage.

Tookitaki's AML Solutions for Payment Companies

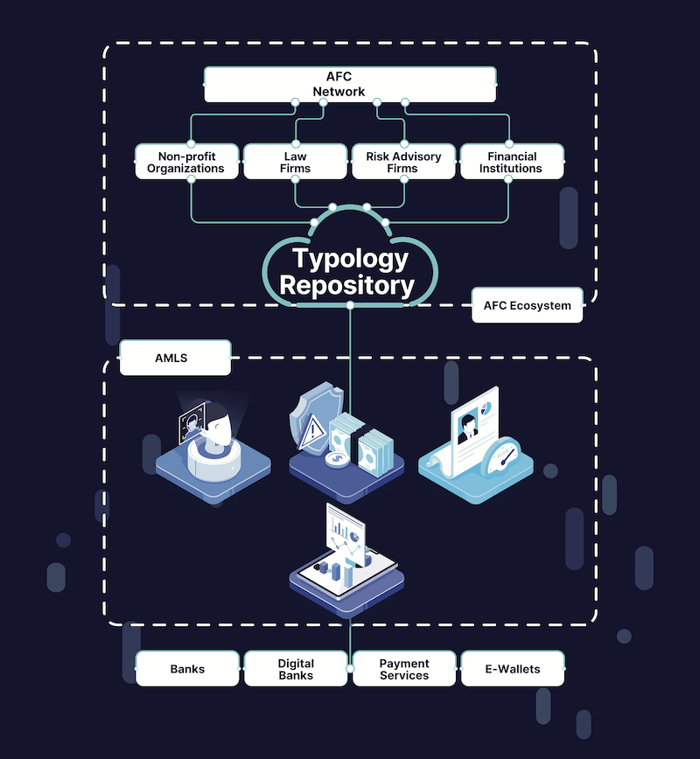

Tookitaki is a pioneer in the fight against financial crime, leveraging a unique and innovative approach that transcends traditional solutions. The company's Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem work in tandem to address the limitations of siloed systems in combating money laundering.

The AFC Ecosystem is a community-based platform that facilitates sharing of information and best practices in the battle against financial crime. Powering this ecosystem is our Typology Repository, a living database of money laundering techniques and schemes. This repository is enriched by the collective experiences and knowledge of financial institutions, regulatory bodies, and risk consultants worldwide, encompassing a broad range of typologies from traditional methods to emerging trends.

The AMLS is a software solution deployed at financial institutions. Our groundbreaking AMLS is an end-to-end operating system that modernises compliance processes for banks and fintechs. The AMLS collaborates with the AFC Ecosystem through federated machine learning. This integration allows the AMLS to extract new typologies from the AFC Ecosystem, executing them at the clients' end to ensure that their AML programs remain cutting-edge. The AMLS also includes several modules such as Transaction Monitoring, Smart Screening, Customer Risk Scoring, and Case Manager. These modules work together to provide a comprehensive compliance solution that covers all aspects of AML, including detection, investigation, and reporting.

In summary, Tookitaki's community-driven, federated learning-based approach is a game-changer in the battle against financial crime. By empowering financial institutions with adaptive technology, Tookitaki ensures that they stay ahead of the curve in effectively detecting and preventing financial crimes.

Ensure Your Company's AML Compliance with Tookitaki's Solutions

In conclusion, the rise of mobile payments in Thailand presents a significant opportunity for payment companies to provide consumers with more efficient and convenient payment options. However, it also challenges ensuring AML compliance to prevent financial crimes such as money laundering and terrorism financing. Tookitaki's AML solutions offer payment companies in Thailand the ability to meet compliance requirements efficiently and effectively through the use of advanced technology.

We encourage payment companies to learn more about Tookitaki's AML solutions and book a demo to see how they can enhance their AML compliance and safeguard their business against financial crime risks.

Anti-Financial Crime Compliance with Tookitaki?