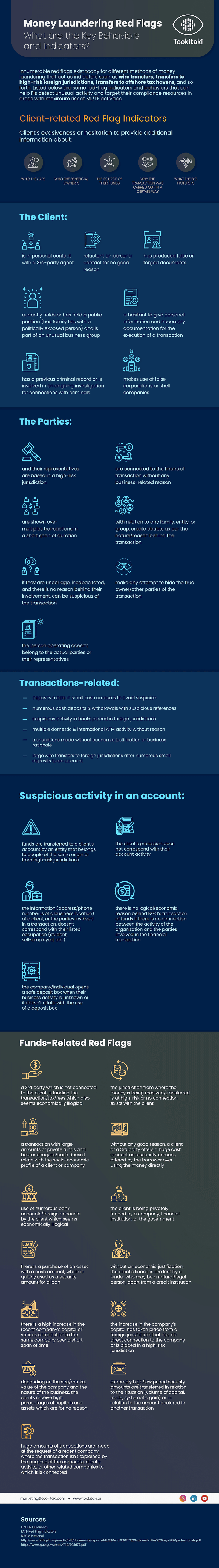

Innumerable red flags exist today for different methods of money laundering such as wire transfers, transfers to high-risk foreign jurisdictions, transfers to offshore tax havens, and they that act as indicators for financial crime investigators.

In this infographic, we have listed some red-flag indicators and behaviours that can help financial institutions detect unusual activity and target their compliance resources in areas with maximum risk of money laundering/terrorist financing (ML/TF).

Ready to Streamline Your

Anti-Financial Crime Compliance with Tookitaki?