An Overview of the UAE's Stand in the Fight Against Money Laundering

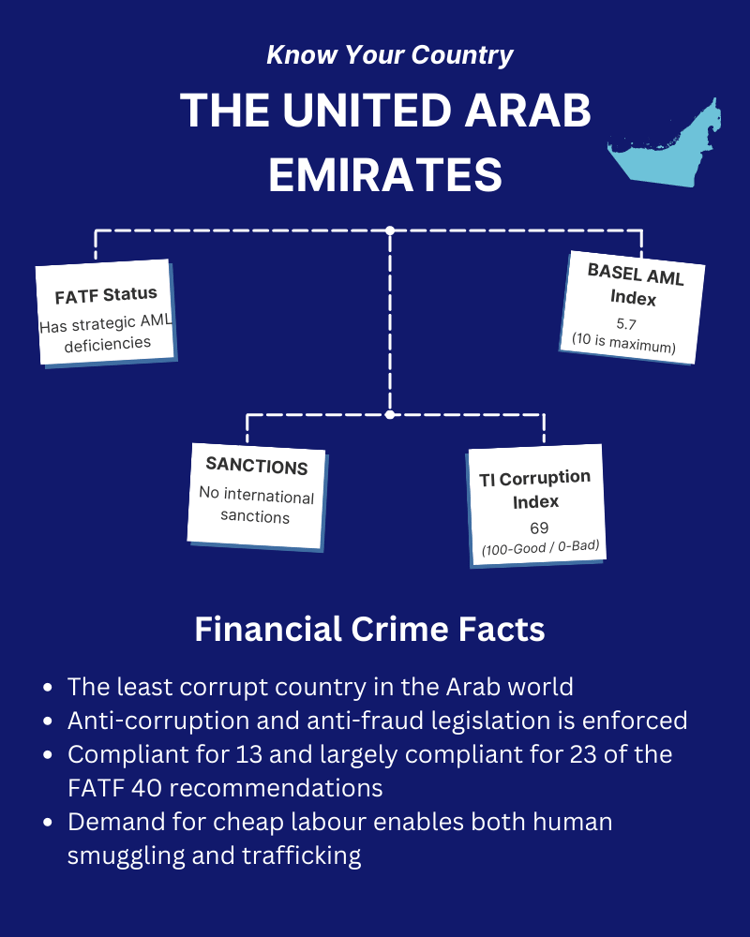

The fight against money laundering and terrorist financing is a critical global issue that has attracted the attention of international organizations, governments, and financial institutions. In this regard, the Financial Action Task Force (FATF) has been at the forefront of efforts to combat these illicit activities. The FATF is an intergovernmental organization established in 1989 with the mandate of setting global standards for anti-money laundering and counter-terrorism financing measures. It comprises of 39 member countries, including the United Arab Emirates (UAE), which has been an active participant in the FATF's efforts.

This blog provides an overview of the UAE's position in the fight against money laundering, and how it has been working with the FATF to combat these illicit activities. We will explore the various measures taken by the UAE to prevent and combat money laundering, and how it has been aligning itself with the FATF's recommendations. Additionally, we will also discuss the challenges faced by the UAE in this regard and the steps being taken to address them. Overall, this blog aims to provide a comprehensive understanding of the UAE's efforts in combating money laundering and terrorist financing, and its commitment to international cooperation in this fight.

The FATF's Evaluation of the UAE's Anti-Money Laundering Efforts

The FATF conducts mutual evaluations of member countries' anti-money laundering and counter-terrorist financing (AML/CFT) systems to assess their compliance with the FATF recommendations and the effectiveness of their efforts to combat these financial crimes.

The FATF's evaluation process assesses both the technical compliance and effectiveness of a country's AML/CFT system. The technical compliance assessment focuses on a country's legal and institutional framework to combat money laundering and terrorist financing, while the effectiveness assessment examines the practical implementation of these measures and their impact on the ground.

Since making a high-level political commitment in February 2022 to work with the FATF and its regional body the Middle East and North Africa Financial Action Task Force (MENAFATF) to enhance the effectiveness of its AML/CFT regime, the United Arab Emirates (UAE) has made significant progress, according to the latest communique by the FATF. Notably, it has demonstrated a sustained increase in outbound mutual legal assistance (MLA) requests to aid in the investigation of terrorist financing, money laundering, and high-risk predicates, shown a greater reliance on financial intelligence to address high-risk ML threats, and effectively combated UN sanctions evasion, including through improved private sector awareness.

According to the international watchdog, the UAE should prioritize the following actions:

- Enhance and maintain a shared understanding of the ML/TF risks across various Designated Non-Financial Businesses and Professions (DNFBPs) sectors and institutions

- Increase the number and quality of Suspicious Activity Reports (SARs) filed by FIs and DNFBPs gain a more granular understanding of the risk of legal persons and, where applicable, legal arrangements being exploited for ML/TF purposes

- Ensure a sustained increase in effective investigations and prosecutions of different types of ML cases that align with the UAE’s risk profile.

The UAE's Regulatory Framework for Combating Money Laundering

The UAE has taken significant steps to combat money laundering and terrorist financing by implementing comprehensive laws and regulations. The country's legal and regulatory framework includes a range of laws and regulations aimed at preventing and detecting money laundering and terrorist financing activities.

The UAE's key laws and regulations related to money laundering include the Federal Decree Law No. 20 of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organizations (AML Law) and Federal Law No. 4 of 2002 concerning the Criminalization of Money Laundering (Old AML Law), which has been amended by Federal Law No.9 of 2014 (AML Amendment Law). The AML Law aims to ensure the UAE's compliance with international standards on issues of money laundering and terrorist financing, and it is aimed at combating money-laundering practices and countering the financing of terrorist activities and other related suspicious organizations.

Additionally, the UAE Central Bank has established a dedicated department, the AML/CFT Department, to handle all anti-money laundering matters and to combat the financing of terrorism (AML/CFT). The department ensures adherence to the UAE's AML/CFT legal and regulatory framework and identifies relevant threats, vulnerabilities, and emerging risks concerning the UAE's financial system. The Central Bank of the UAE has also created regulations for its licensed financial institutions to ensure the adequate organization, supervision, and development of all financial services companies in the UAE.

The UAE's Efforts to Combat Money Laundering in Practice

The UAE has taken significant steps to combat money laundering. According to a report, the UAE's anti-money laundering enforcement actions have led to the imposition of over AED 41 million ($11.2 million) in penalties in the first six months of 2022.

To further strengthen its anti-financial crime framework, the UAE government has reaffirmed its commitment to advancing efforts to combat money laundering and counter terrorist financing, which remains a key pillar underpinning the country's strategy. In August 2021, the UAE established a specialized new court that focuses on combating money laundering. The court is part of the country's efforts to enhance its regulatory environment and align its laws and regulations with international best practices.

Separately, the UAE's National Committee for Combating Money Laundering and Financing of Terrorism and Illegal Organizations (NAMLCFTC) has adopted guidelines to combat money laundering and financial crimes. The guidelines set out a risk-based approach to identify, assess, and understand the money laundering and terrorist financing risks that different sectors face.

The Anti-Money Laundering Law in the UAE requires financial institutions to establish a comprehensive AML/CFT program, including AML policies for know-your-customer (KYC), screening, risk profiling, governance, suspicious transaction reporting (STR) filing, and more. The AML policies and procedures have to be commensurate with the nature and size of the business. Financial institutions can help the country's efforts by using modern technology to identify and mitigate the risks of money laundering.

How Can Tookitaki Help Financial Institutions in the UAE?

Tookitaki is a trailblazer in the fight against financial crime, with a unique approach that sets it apart from traditional solutions. The company's Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem work together to address the shortcomings of siloed systems in the fight against money laundering.

Tooktiaki’s approach starts with our AFC ecosystem which is a community-based platform to share information and best practices in the fight against financial crime. The AFC ecosystem is powered through our Typology Repository which is a live database of money laundering techniques and schemes called typologies. These typologies are contributed by financial institutions, regulatory bodies, risk consultants, etc around the world by sharing their own experiences and knowledge of money laundering. The repository includes a wide range of typologies, from traditional methods such as shell companies and money mules, to more recent developments such as digital currency and social media-based schemes.

The AMLS, on the other hand, is a software deployed at financial institutions, which collaborates with the AFC Ecosystem through federated machine learning. The AMLS extracts the new typologies from the AFC Ecosystem and executes the typologies at the customers' end, ensuring that their AML programs stay ahead of the curve.

Final Thoughts

Tookitaki's AMLS and AFC ecosystem can help financial institutions in the UAE comply with regulations, detect and prevent money laundering, and manage risk more effectively. By leveraging advanced analytics and machine learning algorithms, Tookitaki's solutions provide a comprehensive and customizable approach to regulatory compliance and anti-financial crime. Financial institutions can contact Tookitaki to book a demo of the solutions and learn how they can help them with their AML compliance efforts.

Anti-Financial Crime Compliance with Tookitaki?