In today's complex business environment, intercompany transactions can become a web of intricate financial exchanges. Navigating this maze is crucial for maintaining an accurate balance sheet and ensuring compliance. Financial management in multi-entity organizations poses unique challenges, with intercompany reconciliation standing out as a principal task.

This comprehensive guide aims to dissect every facet of intercompany reconciliation, from its significance to best practices.

What is Intercompany Reconciliation

Intercompany reconciliation is the internal accounting process wherein financial data and transactions between subsidiaries, divisions, or entities within a larger conglomerate are verified and reconciled. In simpler terms, it's like making sure the left hand knows what the right hand is doing within a business. The ultimate goal is to ensure that all the financial records are in sync and accurately represent the company's financial standing.

Intercompany reconciliation, at its core, is a verification process for transactions among various subsidiaries of a parent organization. It's akin to standard account reconciliation but focuses on reconciling transactions between different entities within the company. This process is crucial for maintaining accurate data and avoiding double entries across numerous subsidiaries.

An example of intercompany reconciliation

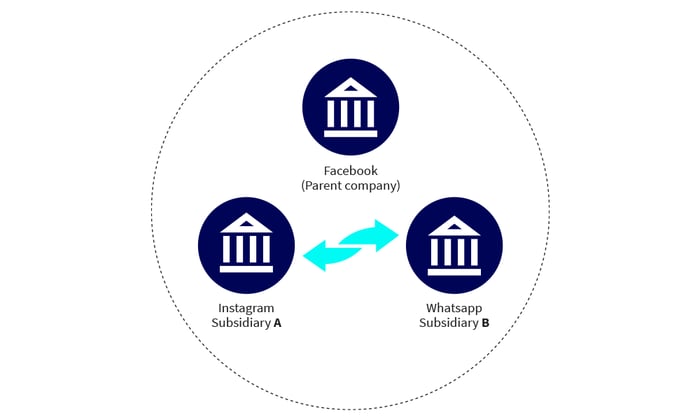

Imagine there is a parent company that has extended its business and now has two subsidiaries. An example of this is Facebook is the parent company and Instagram and Whatsapp are the subsidiaries. If there was a transaction made between Instagram and Whatsapp, there is a need for reconciliation of data so it neither shows as revenue or cost for the company. The intercompany reconciliation reduces the chances of inaccuracies in the company’s financial statements since the money is simply moving around not spent or gained. So when they’ll create the consolidated financial statements at the end of the financial year, there will be no issues because the balance of both accounts will match.

Why Intercompany Reconciliation is Important

Intercompany reconciliation plays a pivotal role in ensuring an organization's financial data's integrity. It mitigates discrepancies in data across multiple subsidiaries, prevents double entries, and provides a clear picture of the company's overall financial status. Intercompany reconciliation is not merely a process but a necessity for several compelling reasons:

- Financial Accuracy: When you reconcile your accounts between different parts of the same company, you make sure the numbers match up. This is super important. If the numbers don't match, then the financial statements you show to investors, the government, or even your own team could be wrong. This could get you in trouble for not following accounting rules.

- Operational Efficiency: Reconciliation isn't just about keeping your books clean; it also helps your company run more smoothly. If you've got a good system in place, you can finish your end-of-the-month financial close faster. This means your finance team can focus on other important things, like helping the company make more money or save costs.

- Risk Mitigation: Ever heard the saying, "A stitch in time saves nine"? Well, that applies to money too. By checking that all your financial records line up correctly, you can spot errors or weird stuff that could be fraud. Catching these things early can save you from bigger headaches down the line, like legal issues or loss of money.

- Regulatory Compliance: There are lots of rules about how companies should manage and report their money. These rules are there to make sure companies are doing business in a way that's fair and above board. When your accounts reconcile properly, it's much easier to follow these rules. This can help you avoid fines or other penalties that come from not being in compliance.

Key Terms in Intercompany Reconciliation

Understanding key terms is crucial for executing the intercompany reconciliation process effectively.

Intercompany Payables

Intercompany payables refer to payments owed by one subsidiary to another within the same parent company. These payables are eventually eliminated in the final consolidated balance sheet to prevent the inflation of the company's financial data.

Intercompany Receivables

Intercompany receivables occur when one subsidiary provides resources to another within the same parent company. Just like intercompany payables, all intercompany receivables need to be eliminated in the final consolidated financial statement.

Intercompany Reconciliation Process and Example

The intercompany reconciliation process can be broken down into several steps:

- Identification of Transactions: Before you can even start reconciling, you need to know what you're looking at. So, the first step is to list all the transactions that have happened between different parts of the company within a certain time frame. This list gives everyone a starting point and helps make sure no transaction gets missed in the process.

- Verification of Data: After you have your list, it's not a one-man show. Each business unit that's part of these transactions goes through the list on its own. They double-check to make sure that what's on the list matches their own records. This is a kind of "trust but verify" step to make sure everyone is on the same page.

- Rectification of Discrepancies: Okay, so what if something doesn't match up? Maybe one unit recorded a transaction that the other missed, or maybe there's a typo in the amount. Whatever it is, both units have to work together to figure out what went wrong and how to fix it. This step is critical for maintaining accurate financial records.

- Review and Approval: The final step is like the cherry on top. Once all transactions have been checked, fixed if needed, and everyone agrees that the list is accurate, it's sent up the chain to senior management. They give it one final review and, if everything looks good, give it their stamp of approval. This last step is crucial for maintaining accountability throughout the organization.

Example: Let's say Company A and its subsidiary Company B both list a transaction involving a $10,000 loan from A to B. During reconciliation, Company A’s account shows a receivable of $10,000, while Company B's shows a payable of $9,900. The discrepancy of $100 is identified and corrected, ensuring both ledgers match and accurately reflect the transaction.

The intercompany reconciliation procedure can be performed manually or through automated solutions, depending on the organization's size and the number of entities involved.

Manual Intercompany Reconciliation

For organizations with one or two small entities, manual reconciliation might be feasible. This process involves identifying all intercompany transactions on each entity's balance sheet and income statement, maintaining consistent data entry standards, and using one of the following processes:

- G/L Open Items Reconciliation (Process 001): This is used for reconciling open items.

- G/L Account Reconciliation (Process 002): This is used for reconciling profit/loss accounts or documents on accounts without open time management.

- Customer/Vendor Open Items Reconciliation (Process 003): This is typically used for accounts payable and accounts receivable linked to customer or vendor accounts.

Even though manual reconciliation is possible, it's time-consuming and prone to errors, particularly as the pressure mounts towards month-end.

Automated Intercompany Reconciliation

Automated intercompany reconciliation, on the other hand, is a more efficient and reliable solution, especially for larger corporations with numerous intercompany transactions. Software solutions like SoftLedger can streamline the reconciliation process, automatically create corresponding journal entries for each intercompany transaction, perform any necessary intercompany eliminations, and reconcile accounts automatically.

Advantages of Automated Intercompany Reconciliation

Automated intercompany reconciliation offers numerous benefits, including access to real-time data, reduced risk of manual errors, faster closing of books, and improved team efficiency. Some software solutions are highly flexible and can be customized to meet specific needs.

Challenges in Intercompany Reconciliation

While intercompany reconciliation is critical, it's not always a walk in the park. Here are some challenges that companies often face:

Complex Transactions:

The business world isn't always straightforward. Sometimes you've got transactions that are like puzzles, with multiple layers and components. These complex transactions aren't just a challenge to carry out; they're also a bear to reconcile. Because of their intricate nature, a simple oversight could lead to significant inaccuracies, requiring extra time and effort to untangle.

Inconsistent Data:

Here's the thing: Not every branch of your company might be doing things the exact same way. Different subsidiaries may use various accounting methods or even different currencies. This lack of uniformity can make it tough to reconcile transactions across the board, complicating an already intricate process.

Human Error:

To err is human, right? But when it comes to reconciliation, even a tiny mistake can snowball into a much larger problem. A misplaced decimal or a forgotten entry could lead to discrepancies that take time and effort to resolve, impacting both the accuracy and efficiency of the entire reconciliation process.

Time-Consuming:

Let's be real: Reconciliation isn't something you can wrap up during a coffee break. Especially for large corporations with subsidiaries scattered across the globe, the reconciliation process can take up a considerable chunk of time. This extended timeline not only delays other vital financial tasks but also incurs additional operational costs.

Regulatory Changes:

If there's one constant in business, it's change. Regulations, laws, and accounting standards are always evolving, and companies have to scramble to keep up. The challenge is that these changes often require alterations in the reconciliation process itself, demanding continuous education and updates for the team responsible for reconciliation.

Best Practices in Intercompany Reconciliation

To overcome these challenges, certain best practices can be super helpful:

Standardization:

Imagine trying to solve a puzzle where the pieces come from different boxes. You'd have a hard time, right? The same goes for reconciliation. Using disparate accounting principles across various business units is like trying to fit mismatched puzzle pieces together. Standardization is your friend here. By using the same accounting methods across all divisions, you make sure those puzzle pieces fit, making the reconciliation process smoother and more reliable.

Automation:

Doing everything manually might give you a sense of control, but let's face it: it's tedious and prone to errors. That's where automation comes in. Specialized reconciliation software can process large volumes of transactions and spot discrepancies like a hawk spotting its prey. Not only does this save time, but it also enhances accuracy, allowing you to focus on more strategic tasks.

Regular Audits:

Think of this as your routine check-up but for your company's finances. Periodic internal audits act as an additional layer of oversight, ensuring that your reconciliation process is not just functional but effective. These audits help identify any weaknesses or areas for improvement, allowing for timely course correction.

Training:

Having the right tools is one thing, but you also need skilled craftsmen to use them. Staff involved in the reconciliation process should be well-trained and up-to-date with the latest accounting standards and company-specific procedures. After all, even the best software is only as good as the people operating it.

Early Reconciliation:

Why put off until month-end what you can do today? Starting the reconciliation process as soon as transactions occur helps you avoid a mad rush at the end of the accounting period. Early reconciliation not only makes the process more manageable but also allows for more time to resolve any discrepancies, ensuring that your financial records are accurate and timely.

Tools and Software for Intercompany Reconciliation

The right tools can make all the difference when it comes to streamlining the reconciliation process. Here are some options:

ERP Systems:

You know how it's easier to find things when they're all in one place? That's what ERP systems do for businesses. These software suites tie together different departments like finance, HR, and supply chain, creating a centralized hub for data. This makes it significantly easier to perform reconciliations, as all the data is readily accessible in one spot, and often in a standardized format.

Specialized Reconciliation Software:

Imagine having a tool that's tailored specifically for the job you're doing—like having a Swiss Army knife where every tool is designed just for reconciliation. Specialized reconciliation software comes equipped with features explicitly aimed at automating and streamlining the reconciliation process. They can handle complex transactions, automatically flag discrepancies, and even generate reports, making the process much more efficient and less prone to error.

Excel Spreadsheets:

Excel is like the pen and paper of the digital age. It's simple, widely used, and most people know how to operate it to some extent. However, just like pen and paper, it has its limitations, especially when it comes to handling complex, large-scale reconciliations. While it might be sufficient for smaller businesses or less complicated tasks, it's not the most robust or error-proof method out there.

Accounting Software:

If specialized reconciliation software is a Swiss Army knife, then general accounting software is more like a regular pocket knife. It can do the job but maybe not as efficiently or comprehensively as you'd like. These platforms often include built-in reconciliation features, which can be quite suitable for small to medium-sized businesses who don't have the budget or need for more specialized tools.

Cloud-Based Solutions:

Think of cloud-based solutions as reconciliation supercharged with the power of the Internet. These platforms allow for real-time data updates and can be accessed from anywhere, making them incredibly useful for businesses that operate across multiple locations or countries. By providing a universal platform that's always up-to-date, cloud-based solutions facilitate more timely and accurate reconciliations.

Conclusion

Intercompany reconciliation is no small feat, but it's an essential process that offers more than just compliance with regulations. By standardizing processes, leveraging the right tools, and consistently monitoring your reconciliation efforts, you can not only make the task less daunting but also contribute to your company's overall financial health.

If you found this guide helpful, consider sharing it with others who might also benefit. The world of intercompany reconciliation can seem complex, but with the right strategies and tools, you can navigate it effectively.

Remember, the aim is to create a seamless, efficient, and transparent system that benefits your organization's financial standing and compliance efforts. So, take the time to assess, plan, and implement the best practices mentioned here. Your balance sheet will thank you!

Additional Resources

For further reading on intercompany reconciliation and related topics, refer to the following resources:

- Excel to AI: How Reconciliation Tools Evolve for Better

- What are the different types of reconciliation?

- What are the methods of account reconciliation?

Frequently Asked Questions (FAQs)

What are the common types of intercompany transactions?

Common types include goods and services trades, loans, and royalties.

What documentation is required for a successful reconciliation?

Documentation like invoices, transaction records, and bank statements are generally required.

How often should reconciliation be done?

This varies but monthly reconciliation is commonly recommended for accuracy.

What are the risks of not doing intercompany reconciliation?

Risks include financial inaccuracies, compliance issues, and potential legal consequences.

Is automation essential for reconciliation?

While not essential, automation significantly reduces errors and saves time.

Anti-Financial Crime Compliance with Tookitaki?