Preventing Money Laundering in Vietnam: Best Practices for Businesses

Money laundering is a serious threat to the global economy and has a significant impact on Vietnam. The proceeds of illicit activities such as drug trafficking, human trafficking, and corruption are laundered through financial institutions, undermining the integrity of the financial system and the economy as a whole. This article will provide an overview of the current state of money laundering in Vietnam, the legal framework for anti-money laundering (AML), best practices for combating money laundering, the consequences of non-compliance, and the role of technology in AML compliance.

Money Laundering in Vietnam

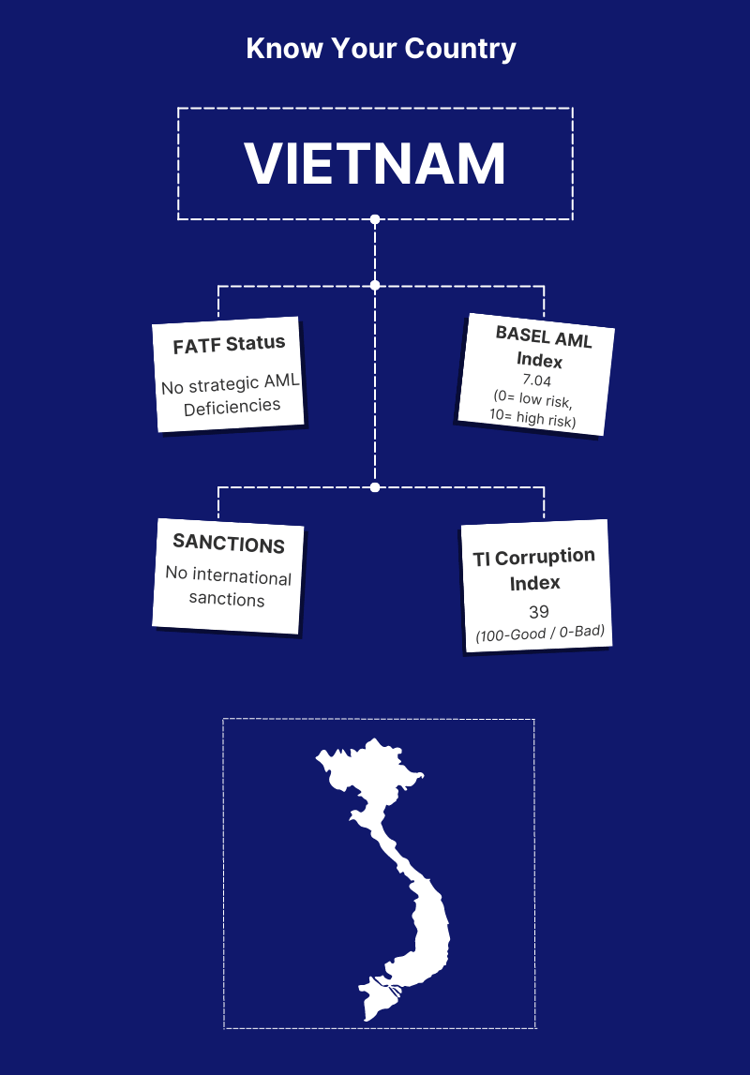

Money laundering is a growing problem in Vietnam, with the country being identified as a major hub for drug trafficking, human trafficking, and other illicit activities. Vietnam's government has made efforts to combat money laundering by implementing various regulations and laws, including the Law on Anti-Money Laundering and the Law on Prevention of Money Laundering.

The State Bank of Vietnam (SBV) is the main regulatory body responsible for combating money laundering in the country. Additionally, the Ministry of Public Security (MPS) oversee AML efforts in the country. The SBV has implemented various regulations and guidelines to prevent money laundering, including Know Your Customer (KYC) requirements, suspicious transaction reporting, and customer due diligence. However, the effectiveness of these measures has been limited due to the lack of resources and expertise.

The consequences of non-compliance with AML regulations in Vietnam can be severe. Financial institutions may face fines, sanctions, or even criminal charges. In addition, non-compliance can damage the reputation of the institution and undermine customer confidence.

Best Practices for Preventing Money Laundering

AML Compliance: The first step towards preventing money laundering is ensuring compliance with AML regulations. This includes establishing policies and procedures for AML compliance, appointing a compliance officer, conducting employee training, and performing regular audits.

Training Employees on AML Policies and Procedures: AML compliance requires the participation and cooperation of all employees in a financial institution. Thus, it is essential to provide training to employees on AML policies and procedures to ensure that they understand their role in preventing money laundering. This training should cover topics such as KYC, customer due diligence, and suspicious transaction reporting.

Conducting Customer Due Diligence: Financial institutions should conduct customer due diligence (CDD) to identify and verify the identity of their customers. This involves collecting and verifying customer information, such as name, address, and identification documents. In addition, financial institutions should also perform ongoing monitoring of customer accounts to detect any suspicious activity.

Transaction Monitoring and Reporting: Financial institutions should implement transaction monitoring systems to detect any suspicious activity, such as unusual transactions or patterns of transactions. Any suspicious activity should be reported to the SBV immediately in accordance with AML regulations.

Internal Audits and Risk Assessments: Regular internal audits and risk assessments are essential for ensuring AML compliance. These audits should be conducted by an independent party and should review the institution's policies, procedures, and controls to ensure they effectively prevent money laundering.

Use of Technology in AML Programs: Technology plays a crucial role in AML compliance by providing automated solutions for transaction monitoring, customer due diligence, and risk assessments. By using technology, financial institutions can improve the efficiency and effectiveness of their AML programs, reduce the risk of human error, and ensure compliance with AML regulations.

The Role of Technology in AML Compliance

Technology plays an increasingly important role in AML compliance. Automated AML solutions can streamline compliance processes and reduce the risk of human error. This can include solutions for customer due diligence, transaction monitoring, and sanctions screening.

Tookitaki is a leading provider of AML solutions for businesses in Vietnam. It is leading the charge in the fight against financial crime with its Anti-Money Laundering Suite and Anti-Financial Crime Ecosystem. Its unique community-based approach, powered by federated machine learning, breaks down the siloed approach used by criminals to evade traditional solutions.

AMLS is designed to be a one-stop shop for financial institutions looking to meet their AML compliance requirements. With its AMLS, financial institutions can reduce the number of false positives, increase the number of true positives, and ultimately improve their overall compliance posture. It includes modules such as Transaction Monitoring, Smart Screening, Customer Risk Scoring, and Case Manager. These modules work together to provide a comprehensive compliance solution that covers all aspects of AML including detection, investigation, and reporting.

Final Thoughts

Vietnam has taken steps to combat money laundering through its legal and regulatory framework, but financial institutions must also take responsibility to prevent it. Leveraging technology such as Tookitaki's AMLS can enhance AML compliance programs, streamline processes, and increase accuracy. Financial institutions in Vietnam must prioritise preventing money laundering through AML compliance measures and using advanced technology solutions like Tookitaki's AML offerings. We encourage businesses to book a demo and see how Tookitaki's solutions can enhance their AML compliance programs and protect them from the risks of non-compliance.

Anti-Financial Crime Compliance with Tookitaki?