The Future of AML Compliance in the UAE: Trends and Predictions

In recent years, the United Arab Emirates (UAE) has emerged as a leading force in the global fight against financial crime. As a thriving financial center in the Middle East, the UAE recognizes the importance of maintaining a robust anti-money laundering (AML) and countering the financing of terrorism (CFT) framework to safeguard the stability and reputation of its financial sector. With increasing regulatory scrutiny and rapidly evolving financial crime threats, it is now more crucial than ever for financial institutions and businesses operating in the UAE to stay ahead of the curve by closely monitoring the latest AML compliance trends and predictions. Doing so will enable them to effectively manage risks, adhere to regulatory requirements, and contribute to the nation's ongoing efforts to combat money laundering and terrorist financing.

This article will provide insights into the current state of AML compliance in the UAE, explore emerging trends, and offer predictions on how the landscape is likely to evolve in the coming years. Armed with this knowledge, businesses and financial institutions will be better equipped to navigate the complexities of AML compliance and contribute to a more secure and transparent financial environment in the UAE.

Regulatory Landscape in the UAE

Recent regulatory changes and their impact on AML compliance

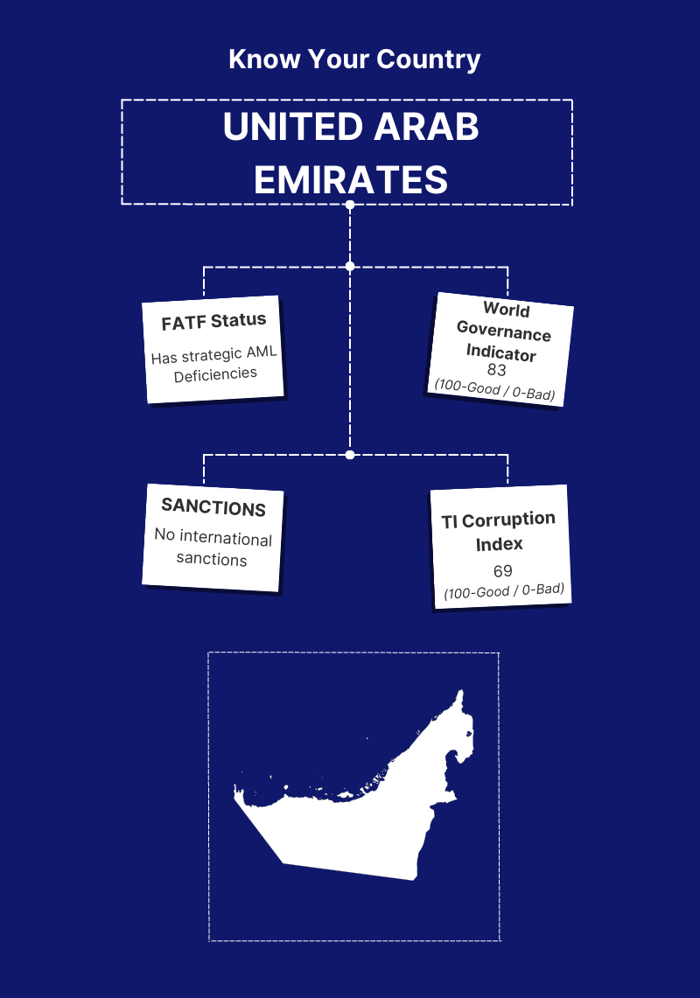

The United Arab Emirates (UAE) has recently introduced several regulatory changes to strengthen its anti-money laundering (AML) and countering the financing of terrorism (CFT) framework. In 2021, the Central Bank of the UAE (CBUAE) published various regulations and standards for the banking sector, covering key financial regulation areas, including AML, consumer protection, and data security. The principal AML/CFT legislation applicable in the UAE is the Federal Decree-Law No. 20 of 2018, which has undergone several amendments and updates since its enactment to align with the Financial Action Task Force (FATF) recommendations.

These regulatory changes have significantly impacted AML compliance in the UAE. Financial institutions are now required to enhance their AML/CFT policies and procedures, invest in sophisticated technology to detect and report suspicious transactions and provide ongoing training for staff to ensure they are well-versed in the latest regulatory requirements. The UAE has also increased its focus on beneficial ownership transparency and established a unified register for corporate entities to disclose their ultimate beneficial owners, further strengthening its AML/CFT framework.

In addition to regulatory updates, the UAE has seen a rise in enforcement actions and the establishment of specialized courts to handle AML cases. The country's commitment to combating financial crime has led to the formation of new departments within regulatory authorities, such as the Central Bank of the UAE, to oversee all aspects of AML/CFT compliance.

Key regulatory authorities and their roles in the UAE

Several regulatory authorities play a crucial role in the AML/CFT landscape in the UAE, overseeing the compliance efforts of financial institutions and ensuring that they adhere to the country's AML/CFT regulations. These key authorities include:

- Central Bank of the UAE (CBUAE): The CBUAE is responsible for supervising and regulating banks, moneychangers, finance companies, and other financial institutions in the UAE. The CBUAE sets guidelines and rules for AML/CFT compliance, conducts on-site inspections, and takes enforcement actions against non-compliant entities.

- Securities and Commodities Authority (SCA): The SCA is the regulatory body for the securities and commodities market in the UAE. It oversees the compliance of market participants, including brokers, investment funds, and listed companies, with AML/CFT requirements and ensures that they implement effective risk management systems.

- Dubai Financial Services Authority (DFSA): The DFSA is the independent regulator of financial services conducted in or from the Dubai International Financial Centre (DIFC), a special economic zone in Dubai. The DFSA enforces AML/CFT regulations for financial institutions operating within the DIFC and closely monitors their compliance with these requirements.

These regulatory authorities collaborate closely and share information to combat money laundering and terrorist financing in the UAE effectively. By working together, they ensure that the UAE's financial sector remains vigilant and resilient against the ever-evolving threat of financial crime.

Emerging AML Compliance Trends in the UAE

Adoption of technology in AML compliance and risk management

Financial institutions in the UAE are increasingly leveraging artificial intelligence (AI) and machine learning (ML) technologies to enhance their AML compliance and risk management efforts. These advanced tools enable institutions to process large amounts of data, identify unusual transactions, and detect complex money laundering patterns more efficiently than traditional methods. By using AI and ML, financial institutions can reduce false positives and proactively identify and mitigate risks associated with money laundering and terrorist financing.

Automation is another key trend in the UAE's AML compliance landscape. Financial institutions are automating routine tasks, such as customer due diligence, transaction monitoring, and reporting, to improve the efficiency and effectiveness of their compliance programs. Data analytics also play a crucial role in AML compliance by uncovering hidden risks and providing valuable insights for decision-making. By integrating automation and data analytics into their AML frameworks, financial institutions can focus their resources on high-risk areas, reduce operational costs, and ensure regulatory compliance.

Greater focus on anti-money laundering (AML) and countering the financing of terrorism (CFT)

In recent years, the UAE has emphasised AML/CFT efforts, resulting in enhanced regulations and more stringent compliance requirements. Implementing risk-based approaches, as recommended by the Financial Action Task Force (FATF), has led to a more comprehensive and effective AML/CFT framework. Financial institutions are now required to assess and manage risks associated with their customers and business activities, implement robust controls and policies, and continuously monitor transactions for suspicious activities.

As money laundering and terrorist financing become increasingly complex and transnational, international cooperation and information sharing have become vital components of the UAE's AML/CFT framework. The UAE actively participates in global initiatives and partnerships, such as the FATF and the Egmont Group of Financial Intelligence Units, to facilitate cross-border collaboration and the exchange of intelligence. By engaging with international partners and sharing best practices, the UAE aims to strengthen its AML/CFT capabilities, ensure the integrity of its financial sector, and contribute to the global fight against financial crime.

Predictions for the Future of AML Compliance in the UAE

Continued regulatory evolution and harmonization

In the coming years, the UAE is expected to enforce existing AML regulations more strictly, holding financial institutions accountable for maintaining robust compliance programs. This stricter enforcement will likely include increased inspections, higher penalties for non-compliance, and enhanced scrutiny of high-risk sectors. As a result, financial institutions will need to ensure that their AML/CFT policies and procedures are up-to-date and effective in mitigating financial crime risks.

As financial crime threats continue to evolve, the UAE is likely to introduce new AML regulations and standards to address emerging risks and align with international best practices. Financial institutions should closely monitor regulatory developments to adapt their compliance programs accordingly. By staying ahead of these changes, organizations can effectively manage potential risks and maintain their reputation in the market.

Increased adoption of technology and innovation in AML compliance

The integration of Regulatory Technology (RegTech) solutions into AML compliance processes is expected to grow in the future. These innovative tools can help financial institutions automate routine tasks, enhance risk assessments, and improve transaction monitoring capabilities. By adopting RegTech solutions, organizations can reduce the costs and complexities associated with AML compliance and increase the accuracy and effectiveness of their compliance efforts.

Data-driven decision-making processes will play an increasingly significant role in AML compliance as financial institutions seek to leverage the vast amount of data available to them. By utilizing advanced analytics and machine learning algorithms, organizations can identify patterns and trends indicative of money laundering or terrorism financing activities more effectively. This data-driven approach will enable financial institutions to make more informed decisions, allocate resources more efficiently, and better manage financial crime risks.

Preparing for the Future of AML Compliance in the UAE

Best practices for financial institutions and businesses

Financial institutions and businesses must regularly review and update their AML compliance programs to stay ahead of evolving regulatory requirements and financial crime threats. This process should include assessing the effectiveness of current policies and procedures, identifying areas for improvement, and implementing necessary changes. By maintaining up-to-date compliance programs, organizations can effectively manage their AML risks and ensure adherence to regulatory requirements.

Investing in technology and staff training is essential for organizations to stay ahead of emerging trends and equip their workforce with the necessary skills to tackle financial crime. By adopting innovative technologies and providing regular AML compliance and risk management training, organizations can enhance their ability to detect and prevent financial crime while ensuring their employees remain knowledgeable about the latest regulatory developments.

Monitoring regulatory developments and adapting accordingly will enable businesses to remain compliant and avoid potential penalties. Financial institutions should establish processes to track regulation changes and guidance from relevant authorities. They should also proactively adjust their AML compliance programs to reflect new requirements or best practices, ensuring they mitigate financial crime risks effectively.

The role of collaboration and partnerships

Engaging with regulators and industry bodies will facilitate a better understanding of regulatory expectations and help businesses navigate the complex compliance landscape. Building strong relationships with regulatory authorities and participating in industry forums can provide valuable insights and guidance on AML compliance best practices and enable organizations to stay informed about emerging trends and challenges.

Sharing best practices and lessons learned will promote knowledge sharing and drive industry-wide improvements in AML compliance efforts. Financial institutions and businesses should actively engage with their peers and participate in industry initiatives to exchange ideas, discuss challenges, and identify opportunities for collaboration. By fostering a culture of cooperation and learning, organizations can collectively strengthen their defences against financial crime and contribute to the integrity of the UAE's financial sector.

How Tookitaki Can Ensure AML Compliance in the UAE

Tookitaki, founded in 2015, is revolutionizing financial crime detection and prevention for banks and fintechs through its two distinct platforms: the Anti-Money Laundering Suite (AMLS) and the Anti-Financial Crime (AFC) Ecosystem. The company's unique community-based approach addresses the silos used by criminals to bypass traditional solutions, resulting in a sustainable AML program with holistic risk coverage, sharper detection, and fewer false alerts.

The AMLS is designed to be a one-stop-shop solution for financial institutions looking to meet their AML compliance requirements. With the AMLS, financial institutions can reduce the number of false positives, increase the number of true positives, and ultimately improve their overall compliance posture. The platform is highly configurable, allowing it to be tailored to the specific needs of each financial institution.

About the AFC Ecosystem

The AFC Ecosystem is a separate entity that aims to discover hidden money trails of criminals. The ecosystem is a body of experts covering the entire spectrum of money laundering, enabling financial partners to uncover money trails not discoverable by today's standards. It is designed to work alongside the AMLS to provide a comprehensive solution for financial institutions.

One of the key features of the AFC ecosystem is the Typology Repository. This is a database of money laundering techniques and schemes that financial institutions around the world have identified. Financial institutions can contribute to the repository by sharing their own experiences and knowledge of money laundering. This allows the community of financial institutions to work together to tackle financial crime by sharing information and best practices.

A typology is a specific money laundering technique or scheme. By sharing typologies in the repository, financial institutions can learn about new and emerging threats, and adapt their AML programs accordingly. The repository includes a wide range of typologies, from traditional methods such as shell companies and money mules, to more recent developments such as digital currency and social media-based schemes.

Tookitaki's AMLS and AFC Ecosystem provide financial institutions with a comprehensive solution for detecting and preventing financial crime. By leveraging advanced technologies such as machine learning and community-based approaches, Tookitaki's platforms offer several key benefits that can help financial institutions improve compliance and prevent financial crime.

Final Thoughts

As the UAE continues to evolve as a global financial hub, proactive AML compliance management is more critical than ever. As regulatory requirements continue to evolve, staying ahead of emerging trends and adopting best practices will be essential for effectively managing AML risks. Technology and innovation are driving the future of compliance in the UAE. Financial institutions and businesses can more effectively identify, manage, and mitigate compliance risks by embracing these advancements and integrating them into their AML compliance programs. By partnering with RegTech companies like Tookitaki, financial institutions in the UAE can better prepare for the future of AML compliance and ensure the integrity of their operations.

We invite you to book a demo today to learn more about how Tookitaki's AMLS and AFC ecosystem can help your organization enhance its AML/CFT compliance efforts. Our team of experts will be happy to discuss your unique compliance challenges and demonstrate how our cutting-edge solutions can help you stay ahead of the curve in the rapidly evolving UAE regulatory landscape.

Anti-Financial Crime Compliance with Tookitaki?