How can Financial Firms Stay Compliant with Thai AML Regulations?

Money laundering is a serious issue that affects economies all over the world. According to a report by the United Nations Office on Drugs and Crime (UNODC), the estimated amount of money laundered globally in one year is between 2-5% of global GDP, or approximately $800 billion - $2 trillion US dollars. To tackle this issue, many countries have established regulatory frameworks to combat money laundering, including Thailand.

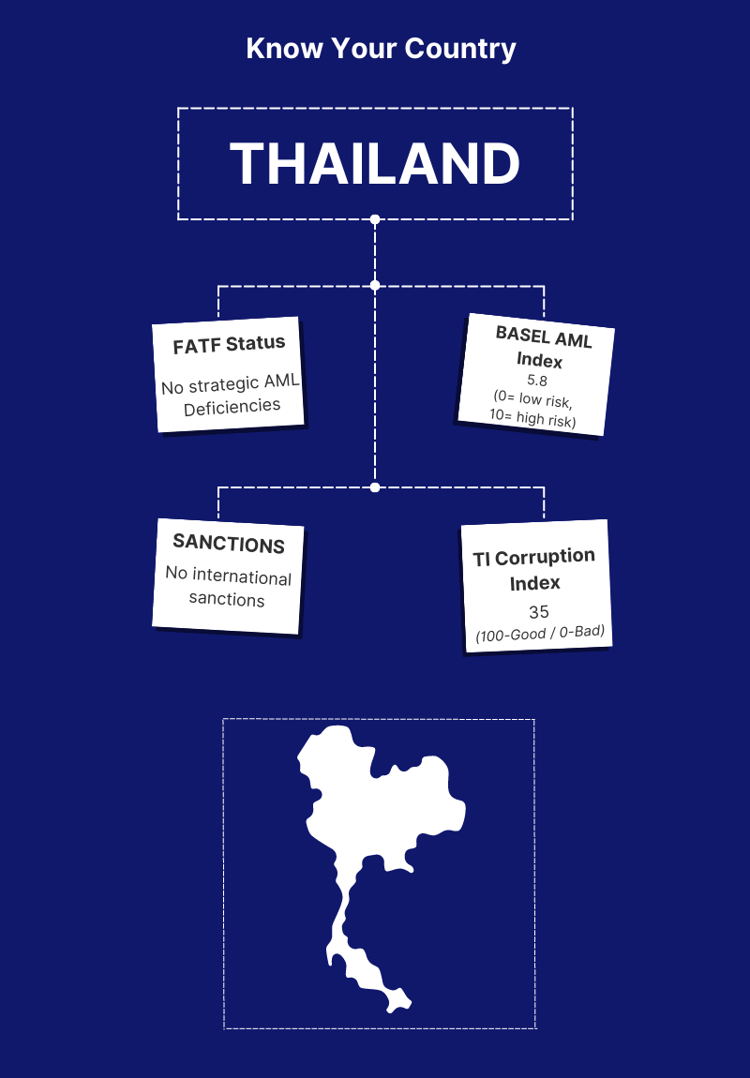

Thailand has been strengthening its Anti-Money Laundering (AML) regime. In 2020, Thailand’s Anti-Money Laundering Office (AMLO) released a new regulation that requires financial institutions (FIs) to adopt a risk-based approach to AML compliance. This means that FIs must assess their risks and vulnerabilities to money laundering and terrorist financing (ML/TF) and implement appropriate AML/CFT measures to manage those risks. This article will discuss how FIs can stay compliant with Thailand's AML regulations and how Tookitaki’s AML solutions can help.

Understanding Thailand's AML Regulations

FIs in Thailand must comply with a number of AML regulations. Here are some of the key regulations:

- Anti-Money Laundering Act B.E. 2542 (1999) and its amendments

- Anti-Money Laundering Office Regulations

- The Counter-Terrorism Financing Act B.E. 2559 (2016)

- The Counter-Terrorism Financing Office Regulations B.E. 2560 (2017)

Thailand's AML regulations are governed by the Anti-Money Laundering Office (AMLO) under the Anti-Money Laundering Act B.E. 2542 (1999). The regulations are designed to ensure that FIs identify, assess, and mitigate the risks of money laundering and terrorist financing. The key requirements for FIs under these regulations include:

- Customer due diligence (CDD): FIs must identify and verify the identity of their customers and beneficial owners.

- Suspicious transaction reporting (STR): FIs must report any suspicious transactions to the AMLO.

- Record keeping: FIs must maintain adequate records of their transactions and customer information.

Challenges FIs Face in Staying Compliant

Staying compliant with AML regulations can be challenging for FIs. The following are some of the common challenges faced by FIs in Thailand:

- Complex regulatory environment: The AML regulations in Thailand are complex and can be challenging to interpret.

- Limited resources: Some FIs may have limited resources to dedicate to AML compliance.

- Lack of expertise: FIs may not have sufficient in-house expertise to implement and maintain an effective AML programme.

FIs that fail to comply with AML regulations in Thailand can face severe penalties, including fines, imprisonment, and reputational damage. In 2020, the AMLO fined 22 FIs a total of THB 896 million (USD 28.7 million) for non-compliance with AML regulations.

How Can FIs Stay Compliant?

A robust AML program is essential for FIs to comply with AML regulations in Thailand. The following are some best practices for FIs to maintain compliance:

Implement a Risk-Based Approach

To comply with Thai AML regulations, FIs must adopt a risk-based approach. This means that FIs must assess their own risks and vulnerabilities to ML/TF and implement appropriate AML/CFT measures to manage those risks.

To implement a risk-based approach, FIs should:

- Conduct a risk assessment to identify their ML/TF risks

- Develop policies and procedures to manage those risks

- Implement ongoing monitoring and reporting mechanisms

FIs should also ensure that they have adequate internal controls and systems in place to detect and prevent ML/TF.

Train Employees on AML/CFT

It’s important for FIs to train their employees on AML/CFT regulations and best practices. This includes training on how to identify suspicious activity, how to report suspicious activity, and how to comply with AML/CFT policies and procedures.

To ensure that employees are aware of their AML/CFT responsibilities, FIs should provide regular training and updates on AML/CFT regulations and best practices.

Monitor Transactions and Conduct Enhanced Due Diligence

FIs must monitor transactions to detect and prevent ML/TF. This includes monitoring for suspicious activity, such as unusual patterns of transactions, and conducting enhanced due diligence on high-risk customers.

To comply with Thai AML regulations, FIs should:

- Establish appropriate transaction monitoring systems

- Conduct enhanced due diligence on high-risk customers

- Screen customers against sanctions lists and politically exposed persons (PEP) lists

How Tookitaki’s AML Solutions can Help

Technology can play a critical role in ensuring compliance with AML regulations in Thailand. A regtech company based in Singapore, Tookitaki is a pioneer in the fight against financial crime, leveraging a unique and innovative approach that transcends traditional solutions. The company's Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem work in tandem to address the limitations of siloed systems in combating money laundering.

The AFC Ecosystem is a community-based platform that facilitates sharing of information and best practices in the battle against financial crime. Powering this ecosystem is the Typology Repository, a living database of money laundering techniques and schemes. This repository is enriched by the collective experiences and knowledge of financial institutions, regulatory bodies, and risk consultants worldwide, encompassing a broad range of typologies from traditional methods to emerging trends.

The AMLS, a software solution deployed at financial institutions, collaborates with the AFC Ecosystem through federated machine learning. This integration allows the AMLS to extract new typologies from the AFC Ecosystem, executing them at the clients' end to ensure that their AML programs remain cutting-edge. Here are some of the key features of Tookitaki’s AML solutions:

Smart Screening: The tool is designed to detect potential matches against sanctions lists, PEPs, and other watchlists. It includes 50+ name-matching techniques and supports multiple attributes such as name, address, gender, date of birth, and date of incorporation. It covers 20+ languages and 10 different scripts and includes a built-in transliteration engine for effective cross-lingual matching.

Transaction Monitoring: The Transaction Monitoring tool is designed to detect suspicious patterns of financial transactions that may indicate money laundering or other financial crimes. It utilises powerful simulation modes for automated threshold tuning, allowing AML teams to focus on the most relevant alerts and improve their efficiency.

Dynamic Risk Scoring: The Dynamic Risk Scoring tool is a flexible and scalable customer risk ranking programme that adapts to changing customer behaviour and compliance requirements. It creates a dynamic, 360-degree risk profile for customers.

Case Management: The solution offers a centralised case management system that enables organisations to track and manage suspicious activity alerts, ensuring that all cases are reviewed and resolved on time. The tool can also generate reports and audit trails, making it easier for organisations to demonstrate their AML compliance efforts.

Final Thoughts

With financial crime on the rise, it is critical for FIs in Thailand to take the necessary steps to ensure AML compliance. This requires a comprehensive approach that includes regular risk assessments, robust internal controls, and advanced technology solutions like those offered by Tookitaki. FIs should consider booking a demo with Tookitaki's AML solutions to see how they ensure compliance with Thailand's AML regulations.

Anti-Financial Crime Compliance with Tookitaki?