The Emergence of Digital Banking and Its Impact on AML in Singapore

Digital banking has emerged as a popular alternative to traditional banking in Singapore. As the world becomes more connected and technologically advanced, the prevalence of digital banking is only set to increase. However, the rise of digital banking also brings new challenges and risks, particularly concerning money laundering. With the convenience and accessibility of digital banking, it is essential to implement robust anti-money laundering (AML) measures to ensure the safety and security of customers' funds.

While there are challenges and risks associated with digital banking, there are also strategies that can be implemented to prevent money laundering. This blog will discuss the potential risks and challenges of digital banking with money laundering, strategies for preventing money laundering, the role of technology in money laundering prevention, and how Tookitaki's AMLS can help digital banks combat money laundering.

What is Money Laundering, and Why is it a Concern?

Money laundering is disguising the proceeds of illegal activities as legitimate funds. It is a concern in the financial industry as it can be used to fund further criminal activities and negatively impact the economy.

In Singapore, money laundering is regulated by the Monetary Authority of Singapore (MAS). The MAS has implemented several measures to prevent money laundering, including customer due diligence requirements and transaction monitoring. Separately, the Payment Services Act requires digital payment service providers to implement robust AML and counter-terrorist financing (CTF) measures.

Digital Banking and Money Laundering: Challenges and Risks

Digital banking poses several challenges and risks regarding money laundering prevention. Compared to traditional banking, digital banking relies heavily on technology and may have different physical customer interactions. This makes it harder to identify and verify customers, which increases the risk of money laundering.

Furthermore, using virtual currencies and other innovative payment methods can make tracing and detecting suspicious transactions even more challenging. Additionally, digital banking transactions can be completed quickly and remotely, making it difficult for banks to identify and prevent suspicious activity in real time.

Strategies for Preventing Money Laundering in Digital Banking

Several strategies can be employed to prevent money laundering in digital banking. These include customer due diligence procedures, transaction monitoring, and risk assessment.

Customer due diligence involves verifying the identity of customers and assessing the risk of money laundering associated with their accounts. Transaction monitoring involves analyzing transactions to identify suspicious activity, while suspicious activity reporting consists in reporting any suspicious activity to the relevant authorities.

These strategies can be implemented using a risk-based approach, where banks assess the risk of money laundering associated with each customer and transaction. Other strategies include conducting regular audits and providing training and education to employees.

The Role of Technology in Money Laundering Prevention

Technology plays a crucial role in money laundering prevention in digital banking. Many digital banks now use artificial intelligence (AI) and machine learning (ML) algorithms to analyze customer data and identify suspicious transactions. These technologies can also be used to automate compliance processes, reducing the risk of human error and improving the efficiency of money laundering prevention efforts.

How Tookitaki Can Help Digital Banks with Money Laundering Prevention

Tookitaki is a company that provides digital banks with various modules to ensure compliance with AML regulations. The company is revolutionizing financial crime detection and prevention for banks and fintechs through our Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem.

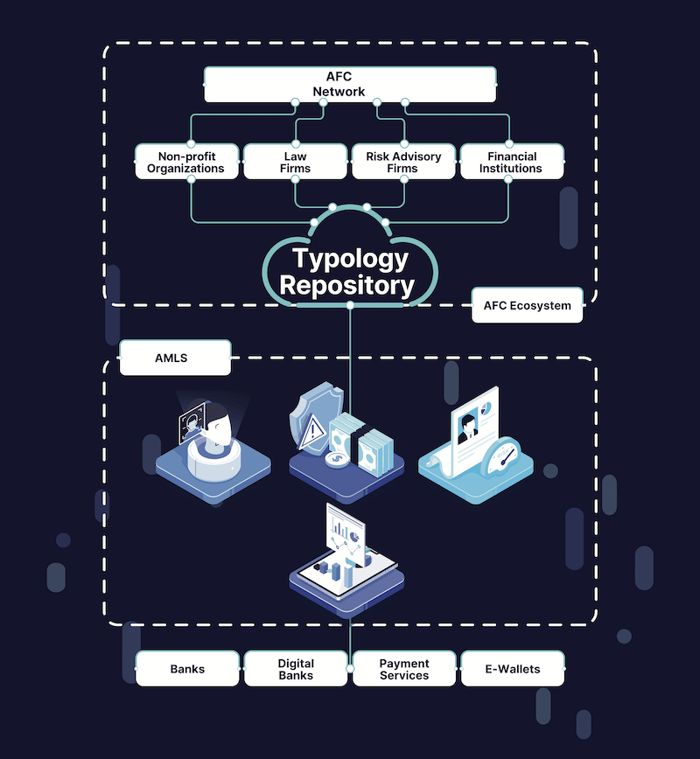

Tooktiaki’s approach starts with our AFC ecosystem, a community-based platform to share information and best practices in the fight against financial crime. The AFC ecosystem is powered through our Typology Repository, a live database of money laundering techniques and schemes called typologies. These typologies are contributed by financial institutions, regulatory bodies, risk consultants, etc., worldwide by sharing their own experiences and knowledge of money laundering. The repository includes many typologies, from traditional methods, such as shell companies and money mules, to more recent developments, such as digital currency and social media-based schemes.

The AMLS, on the other hand, is software deployed at financial institutions, which collaborates with the AFC Ecosystem through federated machine learning. The AMLS extracts the new typologies from the AFC Ecosystem and executes them at the customers' end, ensuring their AML programs stay ahead of the curve.

Tookitaki's AMLS includes Transaction Monitoring, Smart Screening, Customer Risk Scoring, and Case Manager modules. These modules work together to provide a comprehensive compliance solution that covers all aspects of AML, including detection, investigation, and reporting.

Final Thoughts

As digital banking grows in Singapore, it is crucial to consider its impact on financial crime, specifically money laundering. While there are challenges and risks associated with digital banking, there are also strategies that can be implemented to prevent money laundering. Technology is crucial in preventing money laundering, and innovative solutions like Tookitaki's AMLS can help digital banks combat financial crime. By implementing robust AML measures and adopting innovative solutions, digital banks can ensure the safety and security of their customers' funds. Book a demo today if you are a digital bank interested in learning more about Tookitaki's AML solutions.

Anti-Financial Crime Compliance with Tookitaki?