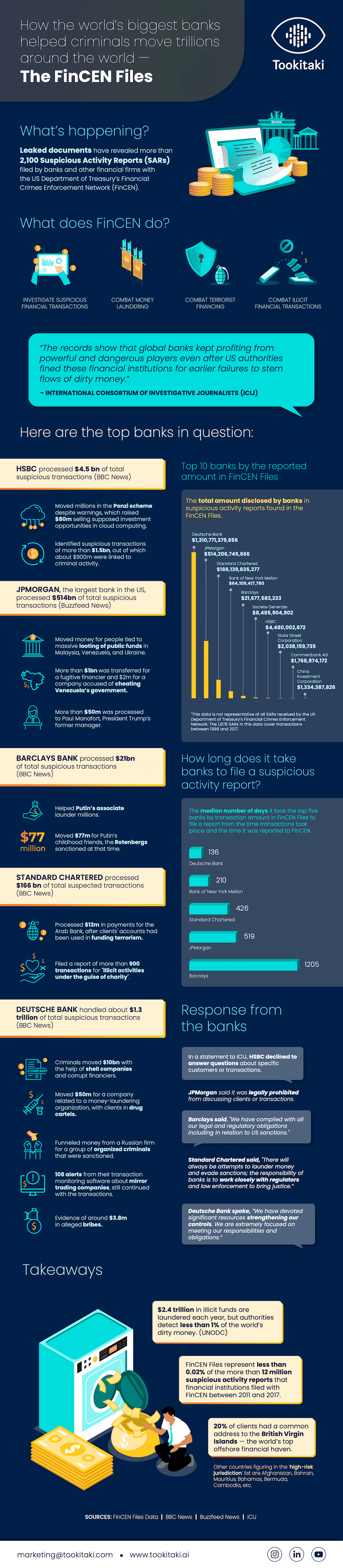

The FinCEN Files refer to a collection of more than 2,100 suspicious activity reports (SARs) leaked from the United States Financial Crimes Enforcement Network (FinCEN). The SARs were filed by banks and other financial institutions between 1999 and 2017, and they involve transactions totaling over $2 trillion.

The International Consortium of Investigative Journalists (ICIJ) and its partners, including BuzzFeed News, published the FinCEN Files in September 2020, revealing how some of the world's largest banks had facilitated the movement of vast sums of money linked to money laundering, corruption, and criminal activities.

The FinCEN Files exposed various loopholes and weaknesses in the global anti-money laundering (AML) and counter-terrorism financing (CTF) systems. The revelations from the leaked documents led to increased scrutiny and calls for stricter regulations and enforcement of AML/CTF laws worldwide.

While the banks flagged the suspicious transactions in SARs, these reports do not necessarily imply wrongdoing by the financial institutions or the individuals involved. Rather, they serve as a way for banks to inform authorities about potentially illicit activities, and it is then up to law enforcement agencies and regulators to investigate further.

The FinCEN Files investigation was a collaborative effort involving more than 400 journalists from 110 media organizations across 88 countries. This massive collaboration allowed for an extensive analysis of the leaked SARs, which revealed patterns of financial misconduct, potential money laundering, and other illegal activities.

Some key findings from the FinCEN Files include:

- Major global banks were involved in processing suspicious transactions. Despite previous fines and promises to improve their compliance systems, these banks continued to facilitate potentially illicit transactions. The leaked SARs exposed the role of anonymous shell companies in facilitating financial crimes. These shell companies, often registered in offshore jurisdictions with lax regulations, were used to hide the true beneficial owners of the funds being moved.

- The FinCEN Files revealed that banks often delayed submitting SARs for months or even years after identifying suspicious transactions. This delay might have allowed criminals to continue their activities without immediate intervention from law enforcement.

- The investigation highlighted the inadequacy of existing AML/CTF regulations and enforcement, as well as the need for greater transparency in the global financial system.

- The FinCEN Files also exposed the involvement of high-profile individuals, including politicians, businesspersons, and celebrities, in potentially illicit financial activities.

In response to the FinCEN Files, various regulatory authorities worldwide have vowed to strengthen their AML/CTF regulations and take stricter actions against financial institutions that fail to comply. Moreover, the investigation has prompted discussions on enhancing international cooperation and information sharing to combat financial crimes more effectively.

As the FinCEN Files demonstrate, the global financial system still has significant vulnerabilities that can be exploited by criminals. The revelations have highlighted the importance of ongoing efforts to improve AML/CTF systems, increase transparency, and hold financial institutions accountable for their role in preventing financial crimes.

Explore the below infographic for more details into the biggest intelligence information leak in the AML/CFT space, revealing "how some of the world's biggest banks have allowed criminals to move dirty money around the world", according to the BBC.

Anti-Financial Crime Compliance with Tookitaki?