Case Study

A Tech-Driven AML Compliance Solution To Meet Evolving Regulatory Requirements For A Leading Payments Firm

THE CLIENT

PayMongo – Empowering the Philippines’ Digital Economy

Founded in 2019, PayMongo is a leading fintech company revolutionising digital payments in the Philippines. By providing seamless payment solutions for businesses of all sizes, from startups to large enterprises, it empowers the country’s growing online economy. As it rapidly scales, PayMongo recognised the need for a robust compliance framework to address the increasing complexities of AML and fraud risks in the digital payments landscape.

THE CHALLENGE

Scaling compliance operations to support complete coverage of regulatory requirements.

The client needed a scalable, technology-driven AML/TF compliance solution to meet evolving BSP and AMLC regulations while minimising operational costs and manual processes as their business rapidly grew. Some of the key considerations were -

(1) A solution that will provide comprehensive risk coverage, meeting BSP and AMLC-’s expectations.

(2) Minimize false alert volumes to keep costs on track and for operational efficiency.

(3) A simple easy-to-use operations tool that can automate AML Compliance operations.

THE SOLUTION

A Scalable, Future-Ready Compliance Model for PayMongo

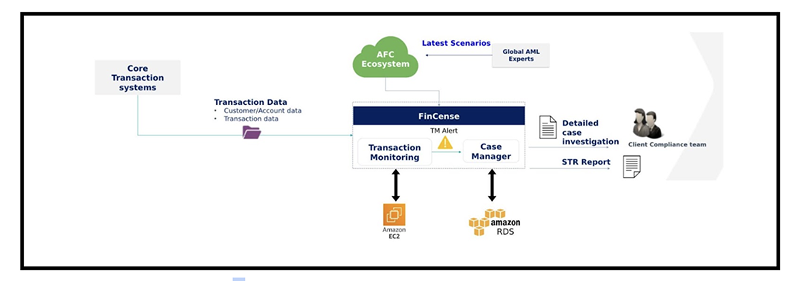

To address PayMongo's need for a scalable and cost-effective AML/TF compliance solution, Tookitaki's advanced module was deployed, replacing their existing transaction monitoring tool. This solution enhanced suspicious transaction detection and risk mitigation while maintaining operational cost efficiency.

1. High-Level Details:

- Access to the Global AFC Ecosystem: The solution provided access to a vast repository of expert-contributed financial crime scenarios, ensuring compliance with evolving BSP and AMLC regulations.

- Out-of-the-Box Scenarios: Pre-built, regularly updated scenarios reduced manual efforts while keeping the system aligned with emerging AML/TF risks.

- Faster Scenario Onboarding: Fully automated scenario deployment reduced onboarding time from months to days, enabling quick adaptation to new threats without additional costs.

- Streamlined Investigations and Reporting: The integrated Case Manager provided a comprehensive risk view, optimizing investigation workflows and ensuring efficient compliance operations.

- Cloud-Based Flexibility: The cloud-based solution minimized dependency on internal IT by managing infrastructure, software maintenance, and upgrades, allowing the client to focus entirely on compliance.

2. Technical Details:

Amazon EC2 Systems Manager:

Automated operational tasks, including patch management and system updates, ensuring consistent infrastructure readiness.

Centralized configuration management enabled efficient provisioning and management of Tookitaki’s compliance infrastructure.

Provided secure, scalable access to instances, ensuring compliance with BSP guidelines while optimizing resources.

Amazon RDS:

Hosted Tookitaki’s compliance database in a scalable, high-availability environment with automated backups and multi-AZ deployments.

Enabled real-time ingestion and storage of transaction data for advanced analytics to detect hidden AML risks.

Improved performance through read replicas for load distribution during peak compliance operations.

Seamlessly integrated with Tookitaki’s detection engine, supporting dynamic segmentation and real-time scenario tuning.

By leveraging Amazon EC2 Systems Manager and Amazon RDS, Tookitaki's FinCense delivered a robust, scalable, and cloud-based compliance solution tailored to PayMongo’s unique needs, empowering them to stay ahead of evolving AML/TF threats while controlling costs.

Implementation Approach

PayMongo’s seamless transition to Tookitaki’s compliance solution was achieved through a structured approach, leveraging Tookitaki’s proven methodologies and AWS’s robust infrastructure:

- Workshops and Training: Conducted scenario design sessions, data integration workshops, and compliance alignment meetings to address PayMongo’s unique operational needs and regulatory requirements.

- Reusable Tools: Deployed pre-configured ETL scripts, synthetic data sets, and reusable templates to accelerate implementation and ensure consistency.

- Lift-and-Shift Strategy: Migrated PayMongo’s compliance workflows to AWS, ensuring a smooth transition with minimal risk and disruption.

- Joint Governance Framework: Brought together PayMongo’s compliance, IT, and risk teams under a shared governance model to streamline testing, feedback, and deployment cycles.

- Dedicated Implementation Team: A specialized team provided real-time support and resolved challenges promptly, enabling a swift and successful deployment.

This well-orchestrated approach ensured PayMongo’s compliance solution was operational within a short timeframe, meeting the demands of their growing business while staying ahead of regulatory requirements.

Outcomes

PayMongo’s strategic adoption of Tookitaki’s FinCense platform, supported by AWS services, delivered transformative results, revolutionizing their compliance operations:

- Comprehensive Risk Management: Leveraging Tookitaki’s FinCense platform and AWS’s scalable infrastructure, PayMongo significantly enhanced its ability to swiftly address evolving financial crime threats while maintaining compliance with BSP regulations.

- Substantial Alert Reduction: The platform achieved an 8x reduction in average daily alerts, enabling PayMongo’s compliance team to prioritise high-risk cases and optimise workflows.

- Enhanced Detection of STRs: Tookitaki’s advanced detection engine improved the identification of Suspicious Transaction Reports (STRs) by 4x, ensuring a higher degree of accuracy in uncovering financial crime.

- Reduction in False Positives: Powered by Tookitaki’s cutting-edge technology and AWS’s high-performance infrastructure, PayMongo achieved a >90% reduction in false positives, dramatically boosting compliance efficiency.

- Accelerated Scenario Deployment: AWS-enabled automation facilitated a 65% faster deployment of new financial crime scenarios, empowering PayMongo to rapidly respond to emerging threats.

- Cost Efficiency: Hosting Tookitaki’s solution on AWS reduced ongoing maintenance costs and IT dependencies, allowing PayMongo to align compliance investments with long-term business goals effectively.

These outcomes highlight PayMongo’s strengthened compliance framework, enabling proactive and cost-effective management of financial crime risks with the scalability to support future growth.

“It was critical for us to comply with the BSP requirements in time to meet the business demands. Also, Tookitaki helped us simplify our compliance operations by providing with a single platform that effectively manages all AML processes."

Head of Compliance