Regulatory compliance refers to the process of adhering to laws, regulations, and guidelines that are set by regulatory bodies. For financial institutions like digital banks in the Philippines, regulatory compliance is critical to ensure the stability and security of the banking system. The digital banking sector in the Philippines has seen significant growth in recent years, with more traditional banks expanding their digital offerings and new digital banks entering the market. However, with this growth comes an increased need for regulatory compliance. Non-compliance can lead to hefty fines, reputational damage, and even the loss of a banking license. In this article, we will discuss the importance of regulatory compliance for digital banks in the Philippines and how Tookitaki's platform can help.

AML Regulatory Framework for Digital Banks in the Philippines

Digital banks in the Philippines are subject to the same AML regulations as traditional banks. They are regulated by the Bangko Sentral ng Pilipinas (BSP), the country's central bank responsible for ensuring that financial institutions comply with anti-money laundering (AML) regulations. The BSP has issued many circulars and guidelines to provide additional guidance to digital banks on complying with AML requirements. These guidelines cover a range of issues, including customer due diligence, transaction monitoring, and reporting suspicious transactions.

The BSP has issued several circulars that outline the legal and regulatory framework for AML for digital banks in the Philippines. One of the key circulars is Circular No. 1108, which outlines the guidelines for AML and countering the financing of terrorism (CFT) for digital banks in the Philippines.

According to Circular No. 1108, digital banks in the Philippines must have a sound and effective AML/CFT program that covers all their operations and business activities. The circular also requires digital banks to establish appropriate policies, procedures, and internal controls for AML/CFT, including appointing a compliance officer and implementing customer due diligence measures.

In addition to Circular No. 1108, digital banks in the Philippines must comply with the Anti-Money Laundering Act of 2001 (AMLA) and its implementing rules and regulations (IRR). The AMLA requires financial institutions to conduct customer due diligence, monitor transactions, and report suspicious activities to the authorities.

Challenges of AML Regulatory Compliance for Digital Banks in the Philippines

Digital banks in the Philippines face many of the same risks traditional banks face, such as money laundering, terrorism financing, and fraud. However, digital banks also face unique risks due to their reliance on technology. Cybercrime is a growing threat, and digital banks must be prepared to detect and prevent it.

Non-compliance with regulatory requirements can result in significant financial and reputational damage. The Bangko Sentral ng Pilipinas (BSP), the central bank of the Philippines, has the power to impose fines and penalties on banks that fail to comply with regulations. In extreme cases, non-compliance can result in the revocation of a banking license.

The Role of Technology in Regulatory Compliance for Digital Banks in the Philippines

The digital banking landscape in the Philippines is rapidly evolving, with more and more consumers turning to mobile and online banking services. However, with the increase of digital banking comes the need for robust regulatory compliance measures to protect against financial crimes such as money laundering and terrorist financing. This is where technology plays a critical role.

With the right technology, digital banks can streamline their compliance processes, reduce the risk of human error, and stay ahead of regulatory requirements. Additionally, technology can help digital banks identify and mitigate potential risks, ensuring they remain compliant and secure.

To achieve regulatory compliance in the Philippines, digital banks can leverage technology in a number of ways. For example, they can use artificial intelligence and machine learning to automate their risk assessments, transaction monitoring, and KYC processes. This can help them identify suspicious activity more quickly and accurately, while also reducing the burden on their compliance teams. By leveraging technology in these ways, digital banks can achieve regulatory compliance more efficiently and effectively while also improving the overall customer experience.

How Tookitaki Can Help Digital Banks

Tookitaki is a leading AML and compliance solutions provider for digital banks in the Philippines. Its solutions leverage cutting-edge technology to automate compliance processes, reduce false positives, and improve overall efficiency. Additionally, the solutions are designed to be highly configurable, allowing digital banks to customize their compliance programs to meet their specific needs and requirements. With Tookitaki's solutions, digital banks in the Philippines can achieve regulatory compliance more quickly and easily, while also reducing the risk of financial crimes.

Tookitaki's Anti-Money Laundering Suite (AMLS) is a comprehensive and end-to-end AML compliance platform designed to assist financial institutions in detecting, preventing, and managing financial crimes. The platform provides a comprehensive approach to detecting and preventing financial crime, helping digital banks to stay compliant and prevent financial crime while also maximizing operational efficiency and protecting their bottom line.

The AMLS platform includes several modules: Smart Screening, Transaction Monitoring, Dynamic Risk Scoring, and Case Manager.

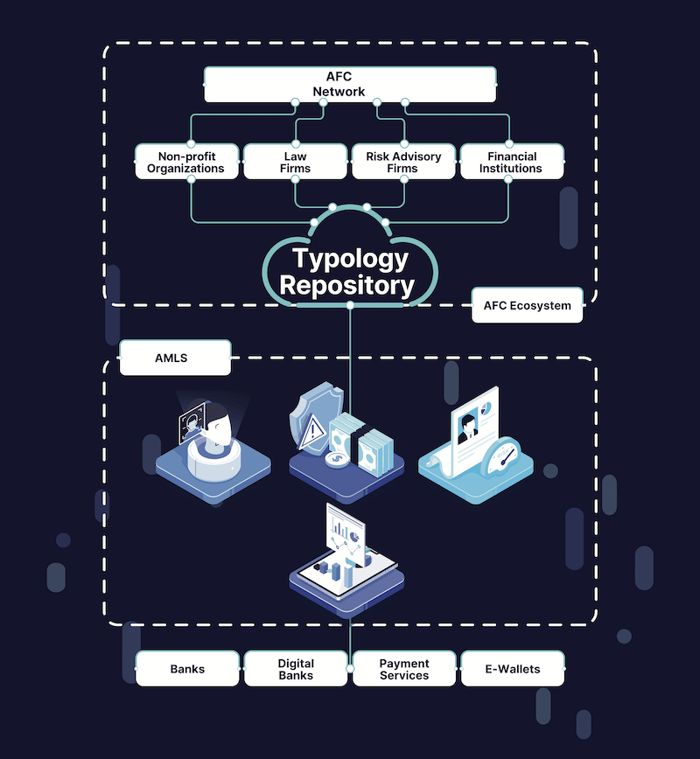

The Anti-Financial Crime (AFC) Ecosystem is a separate platform developed by Tookitaki to aid in the fight against financial crime. It is designed to work alongside Tookitaki's Anti-Money Laundering Suite (AMLS) to provide a comprehensive solution for financial institutions. One of the key features of the AFC ecosystem is the Typology Repository. This is a database of money laundering techniques and schemes that financial institutions worldwide have identified. Financial institutions can contribute to the repository by sharing their money laundering experiences and knowledge. This allows the community of financial institutions to work together to tackle financial crime by sharing information and best practices.

Tookitaki's AMLS platform is designed to be flexible and adaptive, allowing banks to customize the platform to meet their specific needs. The platform is also designed to be scalable, allowing banks to handle large volumes of data.

Final Thoughts

Tookitaki's AMLS platform is a comprehensive and end-to-end AML compliance platform designed to assist digital banks in detecting, preventing, and managing financial crime. The platform provides a comprehensive approach to detecting and preventing financial crime, helping digital banks to stay compliant and prevent financial crime, while also maximizing operational efficiency and protecting their bottom line. We encourage digital banks in the Philippines to book a demo of Tookitaki’s solutions and see the benefits themselves.

Anti-Financial Crime Compliance with Tookitaki?