Various crimes such as corruption, human trafficking, illegal arms sales, embezzlement, insider trading, cyber fraud schemes and illegal drug deals generate large amounts of money for wrongdoers. However, they need to disguise the dirty money’s illegal origin to use it for legitimate purposes. For the purpose, criminals put significant time and effort to devise and execute strategies to conceal the origins of illegally obtained money so that it can be used as they wish. Money laundering is this illegal process of disguising the source of ill-gotten money to make it legitimate.

Money laundering is a complex, global problem that poses significant threats to the integrity of financial systems, economic stability, and society as a whole. This article will provide an overview of what money laundering is, the three main stages involved in the process, and the various techniques used by criminals to launder money. We will also discuss the far-reaching impact of money laundering on the global economy.

The Definition of Money Laundering

The United Nations Office on Drugs and Crime (UNDOC) defines money laundering as “the method by which criminals disguise the illegal origins of their wealth and protect their asset bases, so as to avoid the suspicion of law enforcement agencies and prevent leaving a trail of incriminating evidence.” Money laundering is the process of disguising the proceeds of crime and integrating them into the legitimate financial system. It is often used by organized crime groups to hide the true source of their funds, allowing them to use their illegal gains without detection. In addition, money laundering can have severe consequences for legitimate businesses, as it distorts competition and undermines the integrity of financial markets.

Available Statistics on Money Laundering

It is difficult to estimate the total amount of money being laundered because of the secretive nature of the crime. However, certain estimates point to the grotesqueness of the crime. According to the UNDOC, the amount of money being laundered globally every year is equivalent to 2-5% of global GDP, or USD800 billion – USD2 trillion.

It is important to note that there are multiple crimes that generate hundreds of billions of dollars every year for criminal enterprises. For example, drug trafficking is estimated to make between USD 426 billion and USD 652 billion in yearly proceeds. Meanwhile, human trafficking is more than USD150-billion/year criminal business.

There have been attempts to measure the money laundering risk of countries. One such measure is the Basel AML Index which ranks 125 countries on five domains: quality of AML/CFT framework, bribery and corruption, financial transparency and standards, public transparency and accountability, and legal and political risks. The 10 countries with the highest money laundering risk according to the Basel AML Index 2019 are given in the table below.

Independent research within/about some countries also points out the seriousness of the crime.

- As estimated USD6 billion in drug profits is estimated to be laundered via the black-market peso exchange system in Colombia.

- In the UK, crime proceeds are estimated between £19 billion-£48 billion per year, according to customs authorities.

- In Bangkok, laundered criminal money is projected at 15% of the country’s GDP (USD28.5 billion), according to a 1996 report published by Chulalongkorn University.

- A conservative estimate of profits generated by Mexican drug cartels is about USD 9 billion per year.

- In Canada, Illicit funds generated and laundered amounted to USD5 billion to USD17 billion, according to a 1998 comment by the Canadian Solicitor General.

- According to the Swiss Finance Ministry’s estimates in 1998, the country was implicated in USD500 billion laundered money every year.

- In Indonesia, an amount of USD500,000 is washed per week by West Africans and Southeast Asians using West African Couriers, according to a US law enforcement agency.

- Money laundering activity in Italy totaled more than USD50 billion per year, according to informal estimates in 1997.

The Three Stages of Money Laundering

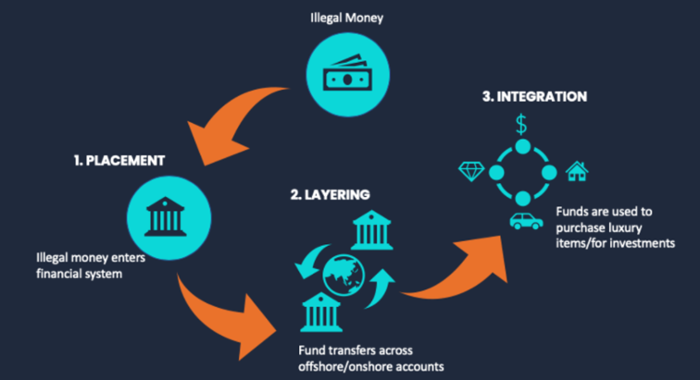

The purpose of money laundering is to convert dirty money into clean money. In order to do that, criminals used to transact money across various financial institutions and countries in various forms of assets or investments, before the money reaches its intended destination. A typical money laundering activity involves three stages:

- Placement: It is the first stage of money laundering and involves introducing ill-gotten money into the financial system by some means. By doing this, the criminal is able to remove the money from the original location of acquisition to avoid detection by law enforcement authorities. For example, a criminal may purchase financial instruments such as cheques and money orders to be deposited into accounts in another location.

- Layering: In the next stage, the criminal carries out complex financial transactions to camouflage the illegal source of the cash. Here, the money can be transferred across multiple institutions and jurisdictions and can also change its form. Money can be transformed into bonds, gold, luxury goods, real estate, or loan repayments. Criminals may also do multiple wire transfers between multiple accounts of different individuals to increase complexity. In order to avoid suspicion, they may break a large amount of money into small amounts. The method is known as smurfing.

- Integration: It involves acquiring wealth or spending on legitimate business activities by using ‘now-laundered money’. At this stage, money reaches the intended destination in a legitimate form. Successful integration of criminal money into the economic or financial system means a successful money laundering attempt. Typically, it is very difficult to catch the criminal if the money reaches this stage.

The stages of money laundering are represented in the image below.

Please note that some of these steps may not be there in some money laundering cases. For example, non-cash proceeds that are already in the financial system need not be placed.

Money Laundering Techniques

Criminals employ various techniques to launder money, including:

- Smurfing: Also known as structuring, this involves breaking down large transactions into smaller, less noticeable ones to avoid detection.

- Shell companies: These are front companies with no real business operations, used to hide the true nature of transactions and disguise the ownership of assets.

- Trade-based laundering: This technique involves manipulating trade invoices to disguise the movement of illicit funds. For example, criminals may overvalue exports or undervalue imports to transfer money across borders.

The Global Impact of Money Laundering

Money laundering has far-reaching consequences for the global economy:

- The scale of money laundering worldwide is estimated to be between 2% and 5% of global GDP, representing a significant drain on the world's resources.

- The economic consequences of money laundering include distortion of market competition, reduced investment, and undermining the integrity of financial institutions. This can lead to decreased economic growth and increased volatility in financial markets.

- The societal implications of money laundering are equally concerning, as it facilitates organized crime, terrorism, and corruption. This can result in increased violence, social unrest, and reduced trust in public institutions.

Conclusion

Combating money laundering is crucial to maintaining the integrity of the global financial system, promoting economic stability, and safeguarding society from the harmful effects of organized crime. Governments and financial institutions play a vital role in detecting and preventing money laundering through the implementation of robust anti-money laundering (AML) policies and regulations. However, increased awareness and vigilance from businesses and individuals are also essential in the fight against this pervasive issue.

As money laundering becomes increasingly sophisticated, financial institutions must employ advanced technologies to prevent, detect and manage financial crime effectively and efficiently. Tookitaki is an award-winning provider of AML compliance solutions. If your financial institution is looking to optimise its AML compliance operations with the help of leading-edge solutions, contact us today and book a demo.

Anti-Financial Crime Compliance with Tookitaki?

.png?width=250&height=104&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White).png)

-1.png?width=200&height=83&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White)-1.png)