Transaction Monitoring in Fintech: Challenges and Solutions

.svg)

While the COVID-19 pandemic has affected the global economy with long-lasting implications for companies and consumers, the Fintech sector has largely been resilient with notable growth across most geographies. A joint study of the sector by the World Bank, the Cambridge Centre for Alternative Finance at the University of Cambridge’s Judge Business School, and World Economic Forum identified Fintech firms have continued to help expand access to financial services during the COVID-19 pandemic—particularly in emerging markets.

“Fintech has shown its potential to close gaps in the delivery of financial services to households and firms in emerging markets and developing economies,” said Caroline Freund, World Bank Global Director for Finance, Competitiveness and Innovation.

She added that the fintech industry is “adapting to the pandemic and offers insights for regulators and policymakers seeking to promote innovation and reap the benefits of fintech while managing risks to consumers, investors, financial stability, and integrity”.

Operational Challenges

Meanwhile, according to the study, fintech companies are also facing operational challenges due to the pandemic. Forty per cent of firms surveyed noted that they have either introduced or are in the process of introducing better fraud or security measures as a response to business conditions under the pandemic. In fact, regulators have also started worrying about compliance within fintech firms, given their increased popularity and growth. They are concerned that neobanks’ compliance processes are not up to the mark, leaving them vulnerable to criminal abuse.

Recently, German regulator BaFin ordered neobank N26 Bank to “rectify deficiencies both in IT monitoring and in customer due diligence”. The order stated that the neobank should hire more personnel, improve the documentation of compliance processes, redo due diligence checks on some existing customers and close backlogs in transaction monitoring. BaFin also appointed a “special commissioner” to update the regulator on the bank’s progress.

N26, which has 7 million customers in 25 markets, clarified that fraudsters misused its platform by pushing third parties to open accounts, which were then used for criminal purposes. “Since the start of the COVID pandemic, criminal activity in connection with online trade has increased dramatically around the world,” the neobank said. “The demands of BaFin aim to prevent the opening of such accounts, to identify illegal financial transactions as quickly as possible, and to block them.”

The Need for Transaction Monitoring

Transaction monitoring refers to monitoring customer transactions such as deposits, withdrawals and transfers for potential illegal behaviour while considering customers’ historical and current information and transactional relationships. Today, financial institutions use various software solutions to analyse transactions as it is not practical for them to have dedicated staff to review each and every one from millions of transactions.

These transaction monitoring systems have various rules and threshold settings to identify potential illegal behaviours and flag those transactions. When a transaction is flagged, a human investigator goes into its details, decides whether it is suspicious or not and reports to relevant authorities if it is suspicious. Transaction monitoring is important for any regulated financial institution as the process acts as a key line of defence against all forms of financial crimes.

Issues with financial crime detection

Criminals worldwide continue to innovate their strategies to launder money despite increased scrutiny by regulators and higher compliance spending by financial institutions. They know how transaction monitoring systems work within financial institutions and have ways to bypass rules and thresholds easily.

Financial institutions need to create new rules and update thresholds to counter new and emerging money laundering and fraud strategies. Financial institutions need several weeks to create, test and implement new rules into their transaction monitoring systems, and rules upgrade may not be a sustainable option given the frequent changes in the regulatory landscape and continuous changes in criminal behaviour.

Operational efficiency is impacted.

On the operational side, financial institutions have the problem of false alerts. While lenient transaction thresholds in monitoring systems would help financial institutions avert risk, they result in a large number of false alerts. While each and every alert needs to be investigated, the pile of false alerts leads to wastage work hours and huge alert backlogs for many institutions. The inability to determine the relative risk of individual alerts adds tremendous operational pressure to AML teams.

{{cta-guide}}

AI for superior AML compliance programs

AI has brought in disruption in many industries with its ability to mine, structure and analyse huge volumes of data and provide actionable insights. AI can take up repetitive tasks, saving valuable time, effort and resources that can be redirected perform higher-value functions. From an AML compliance perspective, AI can extract risk-relevant information from large volumes of data and present that information in a better coherent manner, making the process of identifying high-risk transactions even easier in the fight against financial crime.

Machine learning enables superior data analytics, which can accurately flag anomalous behaviour. The process inefficiencies in AML alert management can be reduced significantly as AI can effectively automate repetitive tasks, saving a lot of man-hours for financial institutions and eliminating alert backlogs. With advanced machine learning, alerts can be grouped based on risk levels to dedicate more time and talent to those that matter. While AI cannot replace human judgment in the AML compliance process, it can assist humans with predictions, recommendations and powerful analytics, enabling faster and more accurate decision-making.

Comprehensive risk coverage with Tookitaki

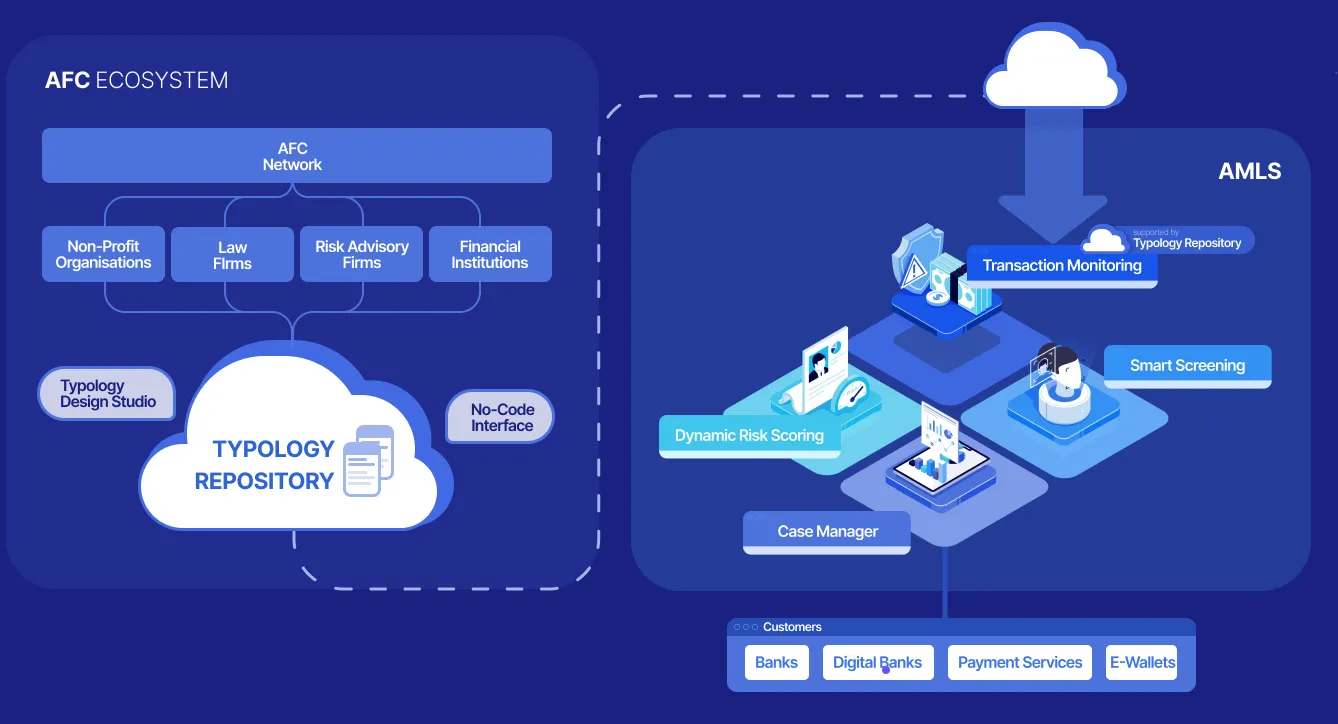

Tookitaki is a pioneer in the fight against financial crime, leveraging a unique and innovative approach that transcends traditional solutions. The company's two distinct platforms: the Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem, work in tandem to address the limitations of siloed systems in combating money laundering.

The AFC Ecosystem is a community-based platform that facilitates sharing of information and best practices in the battle against financial crime. Powering this ecosystem is our Typology Repository, a living database of money laundering techniques and schemes. This repository is enriched by the collective experiences and knowledge of financial institutions, regulatory bodies, and risk consultants worldwide, encompassing a broad range of typologies from traditional methods to emerging trends.

The AMLS is a software solution deployed at financial institutions. It is an end-to-end operating system that modernises compliance processes for banks and fintechs. AMLS collaborates with the AFC Ecosystem through federated machine learning. This integration allows the AMLS to extract new typologies from the AFC Ecosystem, executing them at the clients' end to ensure that their AML compliance programs remain cutting-edge.

Tookitaki's community-based approach significantly enhances the overall effectiveness and efficiency of a financial institution's AML program in several ways:

- Comprehensive Typology Repository: By fostering collaboration between financial institutions, regulatory bodies, and risk consultants, Tookitaki's AFC Ecosystem creates a collective knowledge base through a Typology Repository. This living database contains up-to-date money laundering techniques and schemes, which enables financial institutions to stay informed about emerging trends and threats.

- Enhanced Detection Accuracy: Financial institutions can better identify suspicious activities and potential money laundering risks with access to the latest typologies and schemes. This leads to improved detection accuracy and a more robust AML program.

- Reduction in False Alerts: Tookitaki's innovative technology, combined with the insights from the AFC Ecosystem, helps to minimize false positives. By accurately identifying suspicious activities, financial institutions can focus their resources on high-risk cases and reduce the operational burden of false alerts.

- Adaptive Learning: Federated machine learning enables Tookitaki's AMLS to continuously learn from the AFC Ecosystem, ensuring that the AML program remains adaptive and up-to-date with the latest trends and regulatory changes.

- Streamlined Compliance Processes: Tookitaki's AMLS modernizes compliance processes, making them more efficient and effective. This results in faster response times and allows financial institutions to maintain compliance with evolving regulations.

- Improved Collaboration: The community-based approach encourages knowledge sharing and best practices among financial institutions, regulatory bodies, and risk consultants, fostering a cooperative environment in the fight against financial crime.

Our solution has been proven to be highly accurate in identifying high-risk transactions. For more details of our AMLS solution and its ability to identify various money laundering techniques, please contact us.

Experience the most intelligent AML and fraud prevention platform

Experience the most intelligent AML and fraud prevention platform

Experience the most intelligent AML and fraud prevention platform

Top AML Scenarios in ASEAN

The Role of AML Software in Compliance