Singapore Alert: How Fund Recovery Scams Dupe Victims Out of Millions

.svg)

The Singapore Police have issued a warning regarding Fund Recovery Services Scams, which have been on the rise since January 2024. This type of fraud preys on individuals who have suffered financial losses, offering false promises of recovering their funds through deceptive means. As per reports, there have been over 29 cases since January 2024 resulting in losses of S$1.2 million.

Decoding the Fund Recovery Services Fraud

Imagine this scenario: a scammer might ask for S$200 to start retrieving S$10,000 lost in an investment scam. Additionally, they might demand sensitive information, such as banking credentials, or encourage victims to install remote access software under the pretext of "securing" their accounts, which allows scammers direct access to victims' financial resources. These tactics are designed to extract money or valuable information, further victimizing those already impacted by financial loss.

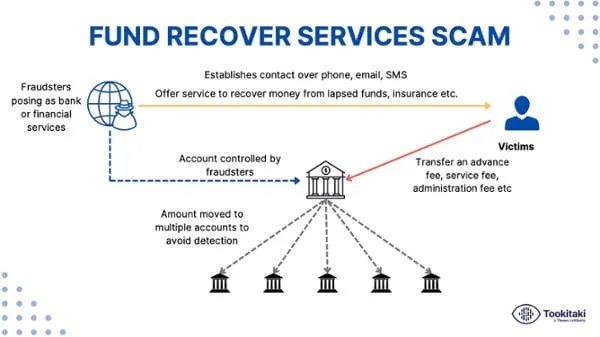

Fund Recovery Services fraud operates through various channels, including calls, messages, or emails, where scammers pose as legal or financial firms. They exploit the vulnerability of victims by presenting themselves as saviours, offering to recover lost funds from investments or scams. The impact of falling victim to such schemes can be devastating, leading to financial losses, emotional distress, and a loss of trust in financial institutions.

Modus Operandi of the Fraud

The modus operandi of this fraud is intricate and deceptive. Here is how it typically happens:

- Scammers masquerade as legal or financial firms, pledging to retrieve lost funds from investments or scams.

- The scammers use various methods to reach potential victims, including:

- Calls: Unsolicited phone calls claiming to represent recovery agencies.

- Messages and Emails: Texts or emails with detailed messages about how they can help recover lost funds.

- Online Advertisements: Ads on social media platforms or websites offering fund recovery services.

- Victims are coerced into making upfront payments for alleged "administrative procedures."

- Extraction Techniques:

- Requesting Banking Credentials: Victims are often asked to provide their banking details under the guise of needing to deposit recovered funds directly into their accounts. Instead, these details are used to drain the victim's bank account.

- Installing Remote Access Software: Under the pretence of assisting or speeding up the recovery process, victims might be persuaded to install remote access software. This software grants scammers unfettered access to the victim's computer, allowing them to steal personal information, install malware, or commit other forms of fraud.

Fund Recovery Services Scams share a striking similarity with Advanced Fee Fraud, a well-known scam tactic where victims are tricked into paying money upfront for services or benefits that never materialize. In both types of scams, fraudsters cleverly ask for money ahead of time, promising victims they'll get back lost funds or receive some form of reward. The catch is, that these upfront payments are said to cover various made-up fees like "administrative charges," "legal fees," or "processing costs."

However, once these payments are made, the promised services or benefits vanish, leaving the victim out of pocket with no real way to recover their funds. This tactic plays on the hope and trust of individuals, making it crucial to be wary of any service that requires payment before delivering results.

Identifying the Red Flags

When dealing with financial transactions online, it's essential to keep an eye out for several key red flags that could indicate the presence of a scam, especially when it comes to Fund Recovery Services Scams. These red flags include:

- Repeated access from unique IPs or unexpected locations: If you notice login attempts to your accounts from places you've never visited, it's a sign that someone might be trying to access your information illegally.

- Mention of dubious websites or applications: Scammers often try to direct their victims to fake websites or ask them to download malicious apps that can steal personal information.

- Encouragement to download third-party apps: This could be a tactic to get malware installed on your device, giving scammers access to your sensitive data.

- Suspicious transactions involving significant amounts of virtual currency: Large, unexplained transactions, especially those quickly moved or converted, can indicate money laundering or fraud.

- Unusually large or frequent transfers to unfamiliar accounts: If you're asked to send money to accounts you don't recognize, especially in large amounts, it's a red flag.

- Payments to entities associated with fraud risk: If the fund recovery service requests payments to accounts or entities previously flagged for fraud, it's likely a scam.

For instance, if you're approached by a fund recovery service that asks you to download a specific app to "safely" recover your lost funds, think twice. This app could be malware designed to steal your banking credentials or personal information. Similarly, if the service insists on payments in virtual currency or to unfamiliar foreign accounts, these are classic signs of a scam operation. Always approach such situations with caution and verify the legitimacy of any service offering to recover funds.

Prevention and Protection

For banks and fintech companies aiming to shield their platforms from Fund Recovery Services Scams and other fraud, it's crucial to implement a comprehensive strategy focused on prevention, detection, and education. Here's how:

- Enhance Detection Mechanisms: Utilize advanced fraud detection technologies that incorporate machine learning and behavioural analytics to identify suspicious activities indicative of scams, including unusual payment patterns or login attempts from strange locations.

- Conduct Rigorous Due Diligence: Before partnering with any fund recovery services, thoroughly vet their legitimacy, including checking for proper licenses, reading up on customer reviews, and verifying their track record in successfully recovering funds.

- Educate Your Customers: Regularly inform your users about the latest scam trends and teach them how to spot red flags. This can be done through newsletters, security alerts, and educational content on your platform.

- Encourage Reporting of Suspicious Activities: Create a simple and secure channel for customers to report any dubious interactions or transactions they encounter, emphasizing the importance of prompt reporting in preventing fraud.

- Collaborate with Authorities and Industry Peers: Work closely with law enforcement and other financial institutions to share intelligence on emerging scams and fraud tactics, enhancing the collective ability to prevent these threats.

Implementing these strategies requires a commitment to ongoing vigilance and investment in cutting-edge fraud prevention technologies. By prioritizing the security of your platform and educating your users, you can create a more resilient defence against Fund Recovery Services Scams and other advanced fraud schemes.

{{cta-ebook}}

Tookitaki's Role in Combating Fraud

Tookitaki plays a crucial role in the fight against fraud and money laundering by providing innovative solutions like FRAML, designed specifically to detect and prevent financial crimes in real time. By harnessing the power of collective intelligence and advanced analytics, Tookitaki offers a robust defence mechanism for banks and fintech companies, ensuring they can safeguard their platforms and their clients from sophisticated scams.

FRAML is at the forefront of this effort, using a community-driven approach to continuously update its knowledge base with the latest fraud patterns. This approach not only helps in identifying potential threats more accurately but also enables financial institutions to stay one step ahead of fraudsters, protecting their assets and maintaining the trust of their customers.

To explore how Tookitaki's FRAML solution can enhance your institution's fraud prevention capabilities and to gain deeper insights into combating financial crimes effectively, we invite you to talk to our experts.

Experience the most intelligent AML and fraud prevention platform

Experience the most intelligent AML and fraud prevention platform

Experience the most intelligent AML and fraud prevention platform

Top AML Scenarios in ASEAN

The Role of AML Software in Compliance