The world continues to battle the COVID-19 pandemic and the crisis it brought in is unprecedented in the history of humankind. While there are a number of pandemic-related factors contributing to the expected crisis with financial services, financial crimes pose a serious threat to their business. As criminals are taking advantage of the outbreak of the COVID-19, financial institutions are trying to address the heightened risk of money laundering. However, they require smarter solutions with better data processing power and faster deployment options to keep up with the change required. Compliance failures, though expected during a crisis like this, can be curtailed to a great extent with the use of the right technology. Modern technology can not only help mitigate risk, but it can augment process efficiency significantly to levels where financial institutions may be able to face similar crises smoothly.

An increasing number of crimes linking to money laundering and terrorist financing forces banks to be extra vigilant with their compliance operations. However, like any other industry, they also face operational difficulties in terms of active work hours, increasing workloads and probably illness among staff. The rising number of pandemic-related crimes means that banks need to be more diligent with changes in customer behavior and customer onboarding. Regulators such as the US Financial Crimes Enforcement Network (FinCEN) acknowledged banks’ challenges in meeting obligations, including the “timing requirements for certain BSA report filings” and accepted the fact that “there may be some reasonable delays in compliance”.

Reiterating that compliance with the Bank Secrecy Act (BSA) remains crucial to protecting national security by combating money laundering and related crimes, FinCEN said it encourages institutions to “consider, evaluate, and, where appropriate, responsibly implement innovative approaches” to meet their anti-money laundering (AML) compliance obligations.

A regtech providing next-gen compliance solutions powered by AI and machine learning, Tookitaki is committed to helping our customers navigate through the existing and upcoming challenges related to AML. With a view to exploring further into the current AML scenario, the company is hosting a power-packed three-part web series in June with well-known thought leaders and industry experts as speakers.

Our first webinar will discuss the impact of COVID-19 on the compliance space and the changes required in current AML/CFT processes to address emerging threats. It will also provide an in-depth review of several coronavirus-specific scams and use cases with suggestions on improved detection abilities. Alerts triaging in an automated and efficient way to manage BSA report filings within the mandated timeframe will be another topic of discussion.

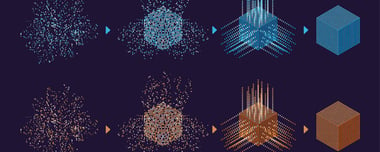

With the banking ecosystem redefined, many banks agree that artificial intelligence (AI) can help build an agile AML system resilient to market and regulatory changes, but for some, deploying AI is complicated, unknown, and more expensive than it might seem. Our second webinar will be focused on debunking the myths surrounding AI implementation in AML programs and will help address audience’s doubts with regard to achieving scale and quicker time-to-value for AML compliance systems, improving AML detection and risk coverage with generalized AI models, moving away from black-box AI to ‘glass-box’ AI and adapting to changing market conditions with a self-learning framework.

Integrating AI-powered AML systems to enhance risk coverage and improve operational efficiency is just the beginning. The future of a robust risk and compliance framework lies in sharing AML wisdom, giving equal footing to all banks and stopping the bad actors together. Our third webinar will focus on a one-of-a-kind approach of federated learning that will help decentralize industry AML knowledge in a privacy-preserved manner for the benefit of the entire industry.

The pandemic has elevated money laundering risks to unprecedented levels but modern technology can be the lifesaver in times of turbulence and post COVID-era. The webinar series is a must-attend for compliance professionals to understand the innovations happening in their space of work.

We have a limited number of slots available. Register for the webinar series soon!

Anti-Financial Crime Compliance with Tookitaki?

.png?width=250&height=104&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White).png)

-1.png?width=200&height=83&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White)-1.png)