Unearthing the Secrets: Shedding Light on Money Laundering Techniques in the Digital Age

Money laundering, a practice deeply rooted in history, persists as a persistent menace to the worldwide economy. It erodes the very foundations of financial systems, empowering illicit enterprises to flourish. With the relentless march of technology, money laundering has undergone a metamorphosis, aligning itself with the digital era. As a result, there is an urgent need for advanced detection techniques and preventive measures.

This comprehensive article ventures into the labyrinthine intricacies of money laundering, illuminating its methodologies, and strategies for detection and emphasising the utmost importance of unwavering vigilance in protecting against this nefarious activity.

What is Money Laundering?

Money laundering stands as a sophisticated method employed to veil the true source of unlawfully obtained funds, camouflaging them to appear lawful. It encompasses a series of intricate manoeuvres aimed at converting ill-gotten gains, often stemming from illicit activities like drug trafficking, fraud, or corruption, into seemingly legitimate assets.

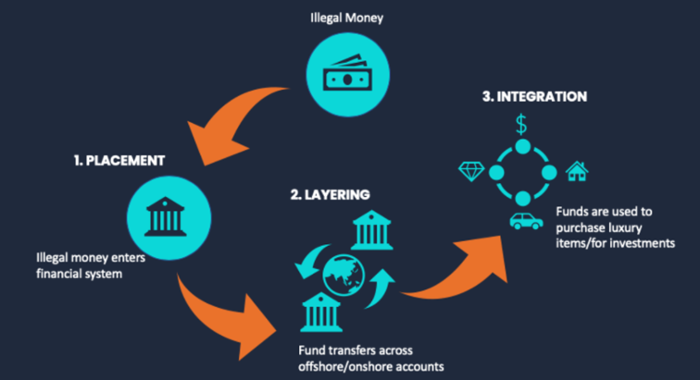

The multifaceted nature of this process unfolds in three distinct stages: placement, layering, and integration, each playing a crucial role in obfuscating the illicit origins and seamlessly integrating the funds into the legitimate financial system.

Money Laundering Techniques

Structuring

Structuring, alternatively referred to as smurfing or the practice of structuring deposits, encompasses the meticulous process of fragmenting substantial sums of illicit funds into smaller, more inconspicuous transactions. The primary objective of this technique is to cunningly sidestep financial reporting obligations and mitigate the level of scrutiny imposed by vigilant authorities. By adopting this approach, money launderers strive to remain under the radar and elude the prying eyes of regulatory entities.

Bulk Cash Smuggling

Bulk cash smuggling encompasses the illicit practice of physically conveying significant volumes of currency across borders or regions, deftly evading the watchful eyes of regulatory controls and sophisticated detection systems. In pursuit of their nefarious objectives, criminals frequently exploit susceptible transportation avenues, skillfully manoeuvring to transport their unlawfully acquired funds discreetly.

Cash-Intensive Businesses

Money launderers strategically capitalize on cash-intensive enterprises, encompassing establishments such as bustling casinos, thriving restaurants, and bustling retail stores, wherein substantial cash transactions are commonplace. With finesse, they intermingle their illicitly acquired funds with the lawful revenue generated by these businesses, cunningly shrouding the dubious origins of their monetary gains.

Investments in Commodities

By engaging in investments within the realm of commodities, encompassing valuable assets like precious metals, exquisite gemstones, or captivating artwork, money launderers skillfully exploit an avenue to imbue their ill-gotten gains with an aura of legitimacy. These alluring assets, prized for their inherent value, boast the advantage of portability, easy storage, and seamless saleability, rendering the task of tracing the funds' initial source a perplexing challenge.

Trade-Based Laundering

Trade-based laundering encompasses the deceptive manipulation of international trade transactions, artfully obfuscating the authentic value attributed to the goods or services being traded. Through crafty schemes involving misrepresenting prices, quantities, or even the commodities' quality, criminals ingeniously navigate the intricate realm of cross-border transactions. This intricate web of deceit enables them to clandestinely move funds across borders, seamlessly camouflaging the illicit origins of their monetary dealings.

Shell Companies and Trusts

Shell companies and trusts serve as instrumental tools utilised to weave an intricate tapestry of interrelated transactions, deliberately adding layers of complexity that pose significant hurdles to tracing the flow of funds. The crafty stratagem employed by money launderers involves the establishment of entities devoid of any genuine business purpose, enabling them to cloak the authentic ownership and control of their assets in a shroud of ambiguity.

Round-Tripping

Round-tripping encompasses the deceptive practice of artificially magnifying transactions, artfully crafting a mirage of bona fide economic activity. Crafty criminals deftly navigate a labyrinthine path, skillfully manoeuvring funds through a convoluted network of intermediaries or jurisdictions. In doing so, they adeptly cloak the funds' true origins and intended purpose, casting a veil of opacity over their illicit endeavours.

Bank Capture

Bank capture pertains to the malevolent infiltration of financial institutions by criminals who skillfully exploit vulnerabilities inherent within the intricate fabric of the banking system. Through cunning manipulation of internal processes or clandestine collusion with complicit bank employees, these unscrupulous actors navigate the institution's inner workings, covertly channelling illicit funds through seemingly legitimate avenues, evading detection and raising minimal suspicion.

Casinos

Money launderers frequently seize upon the abundant opportunities presented by casinos, enticed by the sheer magnitude of cash transactions and the relatively restricted regulatory oversight. Skillfully leveraging this environment, they ingeniously convert their illicit funds into casino chips, engaging in a transient period of gambling to give an illusion of legitimacy to their tainted wealth.

Subsequently, these astute criminals proceed to redeem their chips, obtaining a check in return. This clever manoeuvre effectively conceals the illicit origins of the funds and grants an appearance of lawful validation.

Other Gambling

In addition to casinos, money launderers may readily exploit an array of alternative gambling avenues, spanning from online gambling platforms and sports betting to the realm of lottery systems. Within these diverse domains, characterized by substantial cash flow and an inherent cloak of anonymity, money launderers find alluring opportunities to cleanse their illicit funds. The enticing amalgamation of considerable monetary transactions and the veiled nature of gambling activities renders it an enticing choice for those seeking to obscure the origins of their ill-gotten gains.

Black Salaries

Black salaries denote the illicit practice of remunerating employees through covert means, operating outside the boundaries of official documentation and legitimate record-keeping. This clandestine technique provides a cloak for criminals, enabling them to seamlessly blend their ill-gotten funds into the fabric of the lawful economy, masquerading as bona fide salary disbursements.

Tax Amnesties

Money launderers, on occasion, capitalize on the availability of tax amnesty programs or voluntary disclosure initiatives extended by governmental bodies. By subjecting previously undisclosed funds to tax payment, these unscrupulous individuals can manipulate the system to bestow a cloak of legitimacy upon their ill-gotten riches, effectively sidestepping intensified scrutiny.

Business Email Compromise

In this era of rapid digital advancements, criminals have honed their skills in the realm of money laundering, employing intricate methodologies such as the notorious business email compromise (BEC). This sophisticated technique entails assuming the identity of a genuine business entity through deceptive email communications, cunningly manipulating unsuspecting individuals into unknowingly transferring funds to fraudulent accounts, thereby facilitating the illicit flow of money.

Transaction Laundering

Transaction laundering revolves around the devious art of camouflaging illicit transactions within the guise of a lawful stream of payments. Crafty money launderers skillfully exploit legitimate platforms or businesses as conduits to process their nefarious transactions, effectively concealing the underlying illegal activity and rendering detection a formidable challenge.

Cyber-laundering

In the wake of the burgeoning prominence of cryptocurrencies and the emergence of online financial systems, money laundering has expanded its horizons through the realm of cyber-laundering. Astute criminals harness the power of digital currencies, leverage anonymous online transactions, and navigate intricate webs of financial networks, deftly obscuring the true origins and destinations of their illicit funds.

Money Laundering in the Digital Age

The digital age has presented both challenges and opportunities in the realm of money laundering. The rapid advancement of technology has facilitated the movement of funds across borders, increased anonymity, and provided innovative means for concealing illegal activities. Virtual currencies, online payment systems, and decentralised platforms have become attractive tools for money launderers.

Financial institutions and law enforcement agencies must adapt their detection methods and employ advanced technologies to track illicit transactions in the digital landscape to combat this evolving threat.

Detecting Digital Money Laundering

In order to proficiently identify instances of digital money laundering, institutions must harness the power of cutting-edge analytics, machine learning, and artificial intelligence algorithms. These innovative technologies possess the capability to scrutinize vast quantities of data, unveil intricate patterns, and expose irregularities that serve as red flags for money laundering activities.

Establishing and implementing robust Know Your Customer (KYC) procedures, fortified transaction monitoring systems, and fostering collaborative data-sharing initiatives between institutions and regulatory bodies emerge as pivotal measures in the relentless fight against digital money laundering.

Ways to Prevent Money Laundering

The prevention of money laundering necessitates adopting a comprehensive approach encompassing robust regulatory frameworks, stringent enforcement mechanisms, and proactive measures undertaken by financial institutions. Deploying a wide array of effective strategies, some notable approaches include:

- Enhanced Due Diligence: Instituting comprehensive measures for customer due diligence, encompassing meticulous verification of customer identities, diligent assessment of their risk profiles, and continuous monitoring of transactions to identify any signs of suspicious activity.

- Regulatory Compliance: Ensuring unwavering adherence to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations prescribed by regulatory authorities while perpetually updating internal policies and procedures to stay abreast of ever-evolving threats.

- Training and Awareness: Regularly equipping employees with tailored training sessions to hone their ability to identify telltale indicators, comprehend intricate money laundering techniques, and diligently report any suspicious activities to the appropriate authorities.

- Collaboration and Information Sharing: Actively fostering a culture of collaboration among financial institutions, law enforcement agencies, and regulatory bodies, promoting the seamless exchange of valuable intelligence and reinforcing collective efforts to combat the insidious practice of money laundering.

- Technological Solutions: Making strategic investments in state-of-the-art technological solutions, harnessing the power of cutting-edge systems powered by artificial intelligence, blockchain analytics, and advanced transaction monitoring tools. This proactive approach enhances detection capabilities, elevates risk assessment processes, and fortifies the collective arsenal against the pervasive threat of money laundering.

Final Thoughts

Money laundering continues to pose a formidable challenge to the global financial system, exerting profound threats upon the integrity and stability of economies spanning the globe. Recognizing and comprehending the diverse array of techniques employed by money launderers, particularly in the era of digital advancements, assumes paramount importance in formulating robust strategies for detection and prevention. Embracing cutting-edge technologies, fostering collaborative endeavours, and implementing stringent compliance measures serve as the pillars upon which we can bolster our ability to identify and deter money laundering activities effectively.

In this age of unparalleled digital transformation, maintaining unwavering vigilance and agile adaptability to the ever-evolving landscape of money laundering emerge as indispensable imperatives. By steadfastly embracing a proactive stance and incessantly refining our detection methodologies, we fortify the bulwarks that safeguard our financial systems, shield legitimate enterprises, and contribute resolutely to the global crusade against illicit activities.

Let us always bear in mind that the battle against money laundering demands an unwavering collective effort. Financial institutions, regulatory bodies, law enforcement agencies, and individuals must join forces, hand in hand, in the tireless pursuit of exposing the shadows, unearthing illicit funds, and forging a financial environment that radiates transparency and security for the welfare of all.

FAQs (Frequently Asked Questions)

Q: What is the primary goal of money laundering?

A: The primary goal of money laundering is to make illegally obtained funds appear legitimate by disguising their true origins and integrating them into the legal economy.

Q: How does money laundering in the digital age differ from traditional methods?

A: Money laundering in the digital age takes advantage of technological advancements, such as cryptocurrencies and online platforms, to facilitate illicit transactions. It allows criminals to exploit the speed, anonymity, and global reach of digital financial systems.

Q: How do criminals use shell companies and trusts for money laundering?

A: Criminals establish shell companies and trusts to create a complex web of transactions, making it difficult to trace the flow of funds. These entities provide a façade of legitimacy, allowing money launderers to obscure the true ownership and control of their assets.

Q: What are some effective methods for detecting digital money laundering?

A: Detecting digital money laundering involves leveraging advanced technologies like artificial intelligence and machine learning algorithms. Apart from analysing sizable amounts of data, these technologies can identify patterns and detect anomalies that can indicate money laundering activities.

Q: How can financial institutions prevent money laundering?

A: Financial institutions can prevent money laundering by implementing enhanced due diligence measures, complying with regulatory frameworks, providing comprehensive employee training, promoting collaboration and information sharing, and investing in advanced technological solutions for transaction monitoring and risk assessment.

Q: What role do regulatory bodies and law enforcement agencies play in combating money laundering?

A: Regulatory bodies and law enforcement agencies play a crucial role in setting and enforcing anti-money laundering regulations, conducting investigations, sharing intelligence, and collaborating with financial institutions to detect and prevent money laundering activities.

Q: Why is it important for individuals to report suspicious activities related to money laundering?

A: Individuals play a vital role in the fight against money laundering by being vigilant and reporting any suspicious activities they come across. Reporting such activities can help authorities uncover illicit transactions, disrupt criminal networks, and safeguard the integrity of the financial system.

Q: How can technology contribute to the prevention of money laundering?

A: Technology can contribute to the prevention of money laundering by providing advanced analytics, transaction monitoring tools, and blockchain analytics. These technologies enhance detection capabilities, improve risk assessment processes, and enable more effective identification of suspicious transactions.

Q: What are the potential consequences of failing to prevent money laundering?

A: Failing to prevent money laundering can have severe consequences, including reputational damage, financial losses, legal repercussions, regulatory sanctions, and the facilitation of criminal activities such as drug trafficking, terrorism financing, and corruption.

Q: Why is collaboration between different stakeholders crucial in combating money laundering?

A: Collaboration between financial institutions, regulatory bodies, law enforcement agencies, and individuals is crucial in combating money laundering. It facilitates the sharing of information, intelligence, and best practices, strengthens detection capabilities, and enhances the overall effectiveness of anti-money laundering efforts.

Anti-Financial Crime Compliance with Tookitaki?

.png?width=250&height=104&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White).png)

-1.png?width=200&height=83&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White)-1.png)